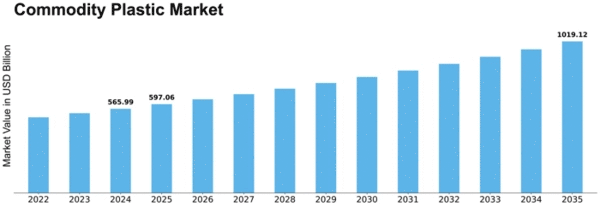

Commodity Plastic Size

Commodity Plastic Market Growth Projections and Opportunities

The commodity plastic market is influenced by several key factors that shape its growth and dynamics. Commodity plastics, such as polyethylene, polypropylene, and polystyrene, are widely used in various industries for packaging, consumer goods, construction, and automotive applications.

One of the primary drivers of the commodity plastic market is the increasing demand for packaging materials. Commodity plastics are favored for their versatility, cost-effectiveness, and ease of processing, making them ideal for packaging applications in food, beverage, pharmaceutical, and retail industries. With the rise of e-commerce and the growing need for efficient packaging solutions, the demand for commodity plastics continues to grow steadily.

The expansion of the consumer goods industry also contributes to the growth of the commodity plastic market. Commodity plastics are used in the manufacturing of a wide range of consumer products, including household items, toys, electronics, and appliances. As disposable income levels rise and consumer preferences evolve, there is a greater demand for affordable and lightweight products made from commodity plastics.

Technological advancements in plastic manufacturing and processing drive market growth by improving efficiency, quality, and product performance. Innovations such as advanced polymerization techniques, additive manufacturing, and recycling technologies enable manufacturers to produce high-quality commodity plastics with enhanced properties, such as strength, durability, and recyclability.

Environmental regulations and sustainability initiatives are becoming increasingly important market factors. With growing concerns about plastic pollution and its impact on the environment, governments and regulatory bodies are implementing measures to promote recycling, reduce plastic waste, and encourage the use of biodegradable and renewable plastics. Manufacturers are responding by developing eco-friendly alternatives and investing in sustainable practices to meet regulatory requirements and consumer expectations.

Market consolidation and competitive strategies shape the competitive landscape of the commodity plastic market. Major players in the industry invest in research and development, mergers, acquisitions, and strategic partnerships to strengthen their market position and expand their product portfolios. Innovation and differentiation are key strategies employed by companies to stay competitive in the market.

Globalization and international trade influence the commodity plastic market by creating opportunities for expansion and competition. Manufacturers can access new markets, leverage economies of scale, and optimize supply chains through international trade agreements and partnerships. However, geopolitical tensions, trade barriers, and tariffs can also impact market dynamics and supply chain operations.

Raw material prices and availability significantly impact the commodity plastic market. Commodity plastics are derived from petrochemicals, and fluctuations in crude oil prices can affect the cost of production and the market price of plastics. Supply chain disruptions, geopolitical factors, and changes in demand also influence raw material availability and pricing, impacting market dynamics.

Economic conditions and consumer spending patterns play a crucial role in driving demand for commodity plastics. Economic growth, industrial development, and urbanization contribute to increased consumption of plastic products in construction, automotive, and consumer goods sectors. Conversely, economic downturns and recessions can lead to reduced consumer spending and demand for plastic products.

Consumer preferences and sustainability concerns influence product development and market trends in the commodity plastic industry. There is a growing demand for recyclable, biodegradable, and renewable plastics as consumers become more environmentally conscious and seek alternatives to traditional plastics. Manufacturers are responding by developing innovative materials and packaging solutions to meet these evolving consumer preferences.

Leave a Comment