Market Growth Projections

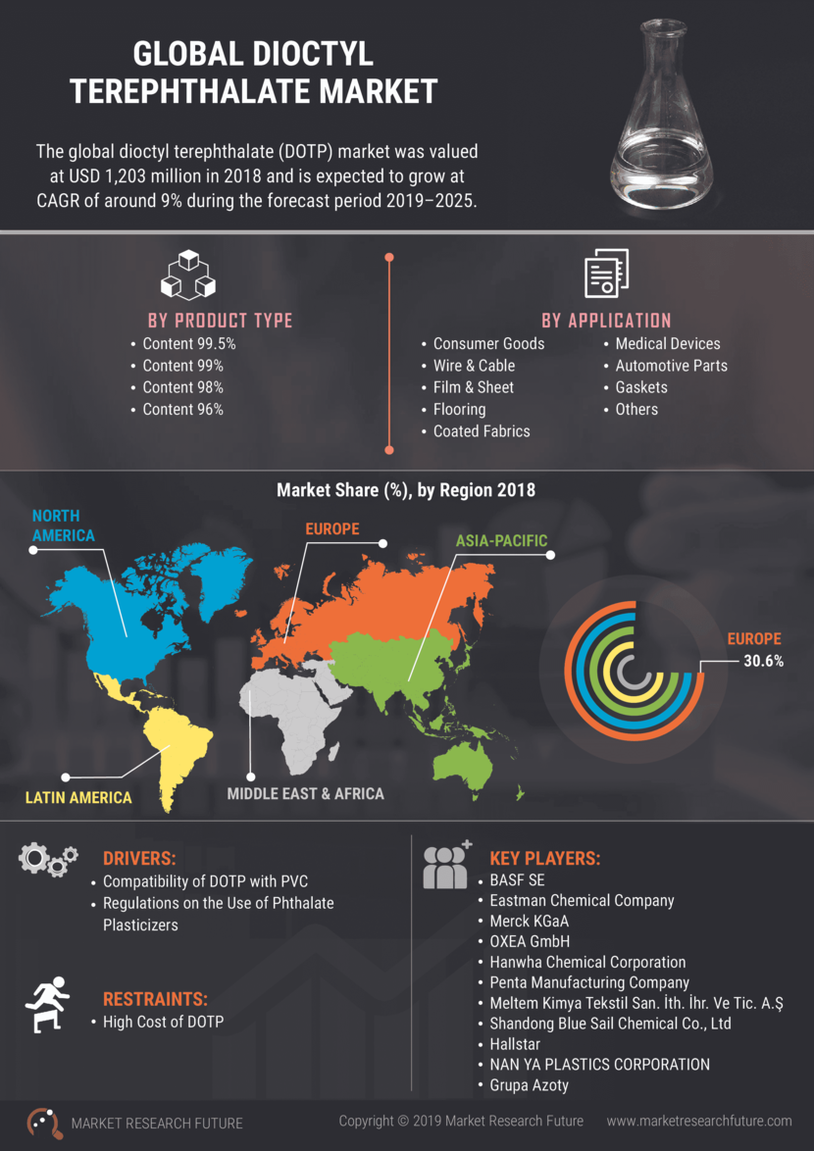

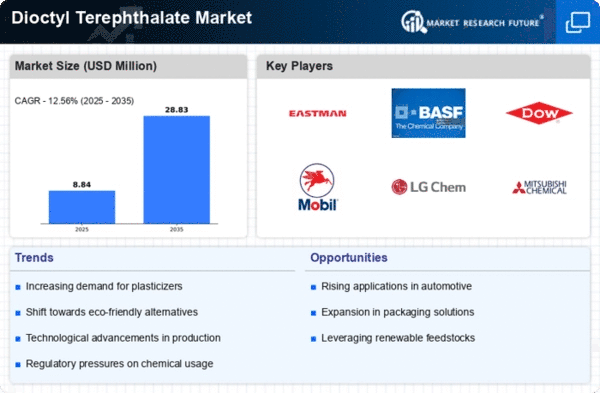

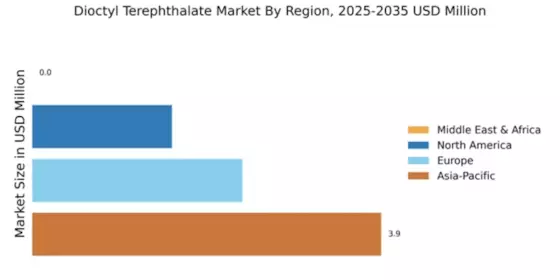

The Global Dioctyl Terephthalate Market Industry is poised for substantial growth, with projections indicating a market value of 1250 USD Million in 2024 and an anticipated increase to 2500 USD Million by 2035. This growth trajectory suggests a compound annual growth rate of 6.5% from 2025 to 2035, driven by various factors including rising demand in automotive and construction sectors, regulatory support for eco-friendly materials, and technological advancements in production. The market's expansion reflects the increasing reliance on Dioctyl Terephthalate Market as a versatile plasticizer in diverse applications.

Growth in Automotive Sector

The automotive industry plays a pivotal role in driving the Global Dioctyl Terephthalate Market Industry. With the increasing production of vehicles, the demand for lightweight and flexible materials has risen. Dioctyl Terephthalate Market is utilized in various automotive components, including interior trims and wiring insulation, due to its excellent performance characteristics. As global automotive production is expected to rise, the market for Dioctyl Terephthalate Market is likely to expand, with projections indicating a market value of 2500 USD Million by 2035. This growth reflects the industry's shift towards more efficient and sustainable materials.

Rising Demand for Flexible PVC

The Global Dioctyl Terephthalate Market Industry experiences a notable surge in demand for flexible polyvinyl chloride (PVC) products. Dioctyl Terephthalate Market, as a primary plasticizer, enhances the flexibility and durability of PVC, making it ideal for applications in construction, automotive, and consumer goods. As the construction sector expands globally, the need for flexible PVC in flooring, wiring, and roofing materials increases. This trend is projected to contribute significantly to the market, with an estimated value of 1250 USD Million in 2024, indicating a robust growth trajectory as industries seek high-performance materials.

Expanding Applications in Consumer Goods

The Global Dioctyl Terephthalate Market Industry is witnessing an expansion in applications across consumer goods. As consumer preferences shift towards products that offer enhanced performance and safety, Dioctyl Terephthalate Market is increasingly used in items such as toys, household goods, and personal care products. Its properties, including flexibility and durability, make it an attractive choice for manufacturers aiming to meet stringent safety standards. This trend is expected to contribute to the market's growth, with projections indicating a market value of 2500 USD Million by 2035, reflecting the increasing integration of Dioctyl Terephthalate Market in everyday products.

Technological Advancements in Production

Technological innovations in the production of Dioctyl Terephthalate Market are enhancing efficiency and reducing costs within the Global Dioctyl Terephthalate Market Industry. Advanced manufacturing techniques, such as continuous production processes and improved catalyst systems, are enabling producers to optimize yield and minimize waste. These advancements not only lower production costs but also improve the quality of the final product. As manufacturers adopt these technologies, the market is likely to see increased competitiveness and growth, aligning with the projected market value of 1250 USD Million in 2024, as companies strive to meet rising demand.

Regulatory Support for Eco-Friendly Plastics

Regulatory frameworks promoting the use of eco-friendly materials are influencing the Global Dioctyl Terephthalate Market Industry positively. Governments worldwide are implementing stringent regulations to reduce the environmental impact of traditional plasticizers. Dioctyl Terephthalate Market, being a more environmentally benign alternative, is gaining traction among manufacturers. This shift is expected to drive market growth, as companies seek to comply with regulations while meeting consumer demand for sustainable products. The anticipated compound annual growth rate of 6.5% from 2025 to 2035 underscores the potential for Dioctyl Terephthalate Market to become a preferred choice in various applications.