Increased Construction Activities

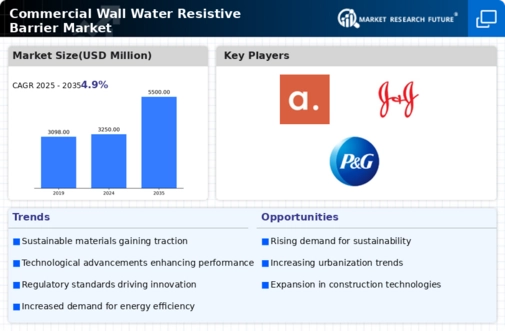

The ongoing rise in construction activities across various sectors appears to be a primary driver for the Commercial Wall Water Resistive Barrier Market. As urbanization accelerates, the demand for new commercial buildings, including offices, retail spaces, and warehouses, is likely to increase. This surge in construction necessitates the incorporation of effective water resistive barriers to protect structures from moisture-related damage. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. Consequently, this growth is expected to bolster the demand for advanced water resistive barrier solutions, thereby enhancing the overall market landscape.

Regulatory Standards and Building Codes

The implementation of stringent regulatory standards and building codes is a significant driver for the Commercial Wall Water Resistive Barrier Market. Governments and regulatory bodies are increasingly mandating the use of water resistive barriers in commercial construction to ensure safety and sustainability. Compliance with these regulations not only protects buildings from moisture damage but also promotes energy efficiency. Recent data indicates that regions with strict building codes have seen a 10% increase in the adoption of water resistive barriers. As these regulations continue to evolve, the market is expected to witness a corresponding rise in demand for compliant barrier solutions, thereby fostering growth in the industry.

Rising Awareness of Building Durability

There is a growing awareness among builders and property owners regarding the importance of building durability, which significantly influences the Commercial Wall Water Resistive Barrier Market. As moisture intrusion can lead to severe structural damage and health issues, stakeholders are increasingly prioritizing the installation of water resistive barriers. This trend is further supported by the increasing incidence of extreme weather events, which heightens the risk of water damage. Market data suggests that the demand for durable building materials is expected to rise, with a projected increase of 7% in the next five years. This heightened focus on durability is likely to drive the adoption of water resistive barriers in commercial construction projects.

Technological Innovations in Barrier Materials

Technological advancements in barrier materials are playing a crucial role in shaping the Commercial Wall Water Resistive Barrier Market. Innovations such as the development of advanced polymer-based materials and breathable membranes are enhancing the performance and effectiveness of water resistive barriers. These new materials not only provide superior moisture protection but also improve energy efficiency in buildings. Market analysis indicates that the introduction of these innovative products is expected to contribute to a market growth rate of around 6% annually. As manufacturers continue to invest in research and development, the availability of high-performance water resistive barriers is likely to expand, catering to the evolving needs of the construction industry.

Sustainability and Environmental Considerations

The growing emphasis on sustainability and environmental considerations is emerging as a key driver for the Commercial Wall Water Resistive Barrier Market. As businesses and consumers alike become more environmentally conscious, there is a rising demand for construction materials that minimize environmental impact. Water resistive barriers that are made from sustainable materials or that enhance energy efficiency are increasingly favored. Market trends suggest that the demand for eco-friendly building solutions is projected to grow by approximately 8% over the next few years. This shift towards sustainability is likely to encourage manufacturers to innovate and offer products that align with these values, thus propelling the market forward.