Increased Focus on Cost Efficiency

Cost efficiency remains a critical driver in the Commercial Vehicle TPM Market. Fleet operators are continually seeking ways to minimize operational costs while maximizing productivity. Effective tire management can lead to significant savings through reduced fuel consumption, extended tire life, and decreased maintenance expenses. The implementation of tire pressure monitoring systems and regular maintenance schedules can enhance tire performance and longevity, ultimately contributing to lower overall costs. As competition intensifies, the emphasis on cost-effective solutions is likely to propel the demand for advanced tire management technologies within the Commercial Vehicle TPM Market.

Regulatory Compliance and Safety Standards

Regulatory compliance is increasingly shaping the Commercial Vehicle TPM Market. Governments worldwide are implementing stringent safety standards and regulations concerning tire performance and maintenance. These regulations aim to enhance road safety and reduce environmental impact. For example, regulations may mandate regular tire inspections and maintenance records, compelling fleet operators to adopt comprehensive tire management practices. The need for compliance not only drives demand for tire management solutions but also encourages innovation in the industry. As regulatory frameworks evolve, the Commercial Vehicle TPM Market is likely to witness a shift towards more advanced and compliant tire management systems.

Technological Integration in Fleet Management

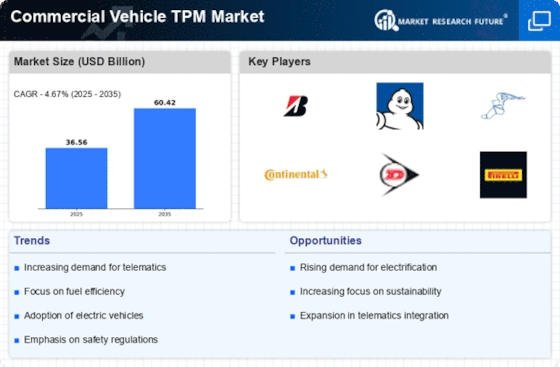

The integration of advanced technologies in fleet management is a pivotal driver for the Commercial Vehicle TPM Market. Innovations such as telematics, IoT, and AI are enhancing tire performance monitoring and predictive maintenance. For instance, telematics systems can provide real-time data on tire pressure and temperature, allowing for timely interventions. This technological shift is expected to increase operational efficiency, reduce downtime, and lower maintenance costs. As fleets become more reliant on data-driven insights, the demand for sophisticated tire management solutions is likely to surge. The market for telematics in commercial vehicles is projected to grow significantly, indicating a robust future for the Commercial Vehicle TPM Market.

Growth of E-commerce and Last-Mile Delivery Services

The rapid growth of e-commerce and last-mile delivery services is significantly influencing the Commercial Vehicle TPM Market. As online shopping continues to expand, the demand for efficient delivery solutions is increasing. This trend necessitates a reliable fleet of commercial vehicles, which in turn drives the need for effective tire management systems. Fleet operators are focusing on optimizing their tire performance to ensure timely deliveries and reduce operational disruptions. The rise in last-mile delivery services is expected to create new opportunities for tire management solutions, thereby enhancing the overall growth of the Commercial Vehicle TPM Market.

Rising Demand for Electric and Hybrid Commercial Vehicles

The transition towards electric and hybrid commercial vehicles is emerging as a significant driver for the Commercial Vehicle TPM Market. As more companies adopt sustainable practices, the demand for electric vehicles is expected to rise. This shift necessitates specialized tire management solutions tailored for electric and hybrid models, which often have different performance characteristics compared to traditional vehicles. The growing emphasis on sustainability and reduced carbon footprints is likely to influence tire design and management strategies. Consequently, the Commercial Vehicle TPM Market may see an increase in innovative tire technologies that cater to the unique needs of electric and hybrid fleets.