Rising Demand in Food Service Sector

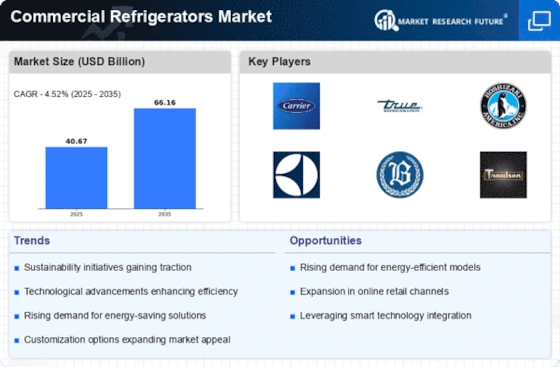

The Commercial Refrigerators Market is experiencing a notable surge in demand, particularly from the food service sector. As restaurants, cafes, and catering services expand, the need for efficient refrigeration solutions becomes paramount. According to recent data, the food service industry is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This growth directly correlates with the increasing requirement for commercial refrigeration systems that can maintain food safety and quality. Additionally, the trend towards takeout and delivery services further amplifies the necessity for reliable refrigeration, as businesses strive to preserve the freshness of their offerings. Consequently, manufacturers are likely to innovate and enhance their product lines to meet the evolving needs of this dynamic sector.

Growth of Retail and E-commerce Sectors

The growth of the retail and e-commerce sectors is a significant driver for the Commercial Refrigerators Market. As online grocery shopping and food delivery services gain traction, the demand for effective refrigeration solutions is escalating. Retailers are increasingly investing in commercial refrigeration systems to ensure that perishable goods are stored and displayed at optimal temperatures. Market analysis indicates that the e-commerce food sector is projected to grow at a rate of 15% annually, which is likely to spur demand for advanced refrigeration technologies. This trend compels manufacturers to develop innovative solutions that cater to the unique needs of e-commerce businesses, such as compact and energy-efficient refrigeration units that can fit into diverse delivery models.

Technological Advancements in Refrigeration

Technological advancements are significantly shaping the Commercial Refrigerators Market. Innovations such as advanced temperature control systems, IoT integration, and energy-efficient compressors are becoming increasingly prevalent. These technologies not only enhance the performance of refrigeration units but also contribute to energy savings, which is a critical consideration for businesses. For instance, the introduction of smart refrigerators equipped with monitoring systems allows operators to track performance metrics in real-time, thereby optimizing energy consumption. Market data indicates that the adoption of smart technologies in refrigeration is expected to increase by over 30% in the coming years. This trend suggests that businesses are prioritizing efficiency and sustainability, driving manufacturers to invest in research and development to stay competitive.

Regulatory Compliance and Food Safety Standards

The Commercial pharmaceutical Refrigerators Market is heavily influenced by stringent regulatory compliance and food safety standards. Governments and health organizations worldwide are implementing rigorous guidelines to ensure food safety, which directly impacts the refrigeration sector. For instance, regulations regarding temperature control and storage conditions are becoming more stringent, necessitating the use of advanced refrigeration solutions. Businesses are increasingly required to invest in high-quality commercial refrigerators that meet these standards, thereby driving market growth. Data suggests that the market for compliant refrigeration solutions is expected to expand by approximately 5% annually as businesses seek to avoid penalties and ensure consumer safety. This regulatory landscape compels manufacturers to innovate and provide products that not only comply with regulations but also enhance operational efficiency.

Consumer Preference for Fresh and Organic Products

Consumer preferences are shifting towards fresh and organic products, which is significantly impacting the Commercial Refrigerators Market. As health-conscious consumers increasingly seek out fresh produce and organic food options, retailers and food service providers are compelled to adapt their offerings. This shift necessitates the use of high-quality refrigeration systems that can maintain the integrity and freshness of these products. Market data suggests that the organic food market is expected to grow by over 10% in the next few years, driving demand for commercial refrigeration solutions that support this trend. Consequently, manufacturers are likely to focus on developing refrigeration systems that not only preserve freshness but also align with the growing consumer demand for sustainability and quality.