Increasing Demand for Water Supply

The Global Commercial Pumps Market Industry experiences a notable surge in demand driven by the increasing need for efficient water supply systems. Urbanization and population growth necessitate enhanced infrastructure, particularly in developing regions. For instance, cities are investing in modern water distribution networks to ensure reliable access to potable water. This trend is reflected in the projected market value of 51.7 USD Billion in 2024, indicating a robust growth trajectory. As municipalities and industries seek to optimize water management, the demand for advanced pumping solutions is likely to rise, further propelling the market forward.

Rising Energy Costs and Efficiency Needs

Rising energy costs are a critical driver for the Global Commercial Pumps Market Industry, as industries seek to minimize operational expenses. The need for energy-efficient pumping solutions is becoming increasingly urgent, prompting manufacturers to innovate and develop pumps that consume less energy while maintaining performance. This trend is particularly relevant in sectors such as agriculture and manufacturing, where energy costs can significantly impact profitability. As organizations prioritize cost reduction and sustainability, the demand for energy-efficient pumps is likely to grow, further stimulating market expansion.

Technological Advancements in Pump Design

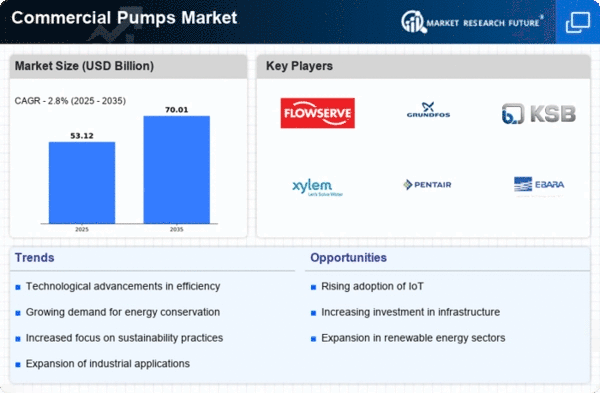

Technological advancements play a pivotal role in shaping the Global Commercial Pumps Market Industry. Innovations in pump design, materials, and energy efficiency are enhancing performance and reliability. For example, the integration of smart technologies allows for real-time monitoring and predictive maintenance, reducing downtime and operational costs. As industries prioritize sustainability and efficiency, the market is likely to benefit from these advancements. The projected CAGR of 2.8% from 2025 to 2035 suggests that the adoption of advanced pumping technologies will continue to influence market dynamics positively.

Industrial Growth and Infrastructure Development

The Global Commercial Pumps Market Industry is significantly influenced by the ongoing industrial growth and infrastructure development across various sectors. Industries such as construction, oil and gas, and manufacturing are expanding, necessitating efficient pumping systems for fluid transfer and management. The anticipated market growth from 51.7 USD Billion in 2024 to 70 USD Billion by 2035 underscores the critical role of commercial pumps in supporting these sectors. As new projects emerge globally, the demand for reliable and durable pumping solutions is expected to increase, thereby driving market expansion.

Regulatory Compliance and Environmental Standards

The Global Commercial Pumps Market Industry is increasingly impacted by stringent regulatory compliance and environmental standards. Governments worldwide are implementing policies aimed at reducing energy consumption and minimizing environmental impact. This regulatory landscape compels industries to adopt energy-efficient pumping solutions that comply with these standards. As a result, manufacturers are focusing on developing pumps that meet or exceed these requirements. The emphasis on sustainability is expected to drive innovation and growth within the market, aligning with global efforts to promote environmentally responsible practices.