Growth in Air Travel Demand

The Commercial Aircraft Material Market is poised for expansion due to the rising demand for air travel. As economies develop and disposable incomes increase, more individuals are opting for air travel, leading to a surge in aircraft orders. The International Air Transport Association projects that passenger numbers could reach 8.2 billion by 2037, necessitating a significant increase in aircraft production. This demand for new aircraft directly influences the Commercial Aircraft Material Market, as manufacturers require advanced materials to construct these aircraft efficiently and safely. Consequently, the industry is likely to see a robust increase in material procurement to meet this burgeoning demand.

Increasing Demand for Fuel Efficiency

The Commercial Aircraft Material Market is experiencing a notable shift towards materials that enhance fuel efficiency. Airlines are increasingly prioritizing fuel-efficient aircraft to reduce operational costs and meet environmental regulations. Advanced materials such as carbon fiber reinforced polymers and lightweight alloys are being adopted to decrease aircraft weight, which directly correlates with fuel consumption. According to industry estimates, the use of advanced materials can lead to a reduction in fuel burn by up to 20%. This trend is likely to continue as airlines seek to optimize their fleets and improve profitability, thereby driving growth in the Commercial Aircraft Material Market.

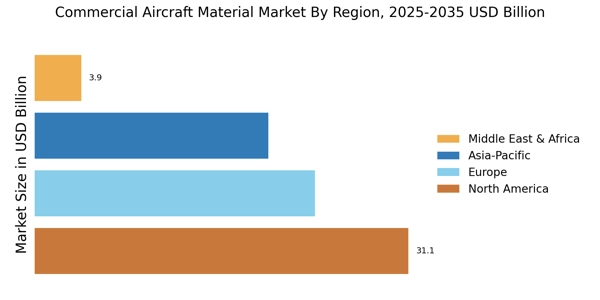

Emerging Markets and Regional Expansion

The Commercial Aircraft Material Market is witnessing growth driven by emerging markets and regional expansion. Countries in Asia-Pacific and the Middle East are investing heavily in their aviation sectors, leading to increased demand for new aircraft and, consequently, materials. The rise of low-cost carriers in these regions is further fueling the need for cost-effective and lightweight materials. As these markets develop, they present significant opportunities for material suppliers to establish a foothold and cater to the unique needs of regional aircraft manufacturers. This trend is likely to enhance the Commercial Aircraft Material Market, as suppliers adapt to meet the diverse requirements of these expanding markets.

Regulatory Pressures for Emission Reductions

The Commercial Aircraft Material Market is increasingly influenced by regulatory pressures aimed at reducing emissions. Governments and international bodies are implementing stringent regulations to curb greenhouse gas emissions from aviation. This has prompted aircraft manufacturers to seek materials that not only comply with these regulations but also enhance the overall sustainability of aircraft. The adoption of lightweight materials and eco-friendly composites is becoming essential to meet these regulatory standards. As a result, the Commercial Aircraft Material Market is likely to see a shift towards more sustainable material options, which could reshape the competitive landscape and drive innovation.

Technological Innovations in Material Science

Technological advancements in material science are significantly impacting the Commercial Aircraft Material Market. Innovations such as additive manufacturing and nanotechnology are enabling the development of new materials that offer enhanced performance characteristics. For instance, the introduction of 3D printing technology allows for the production of complex components with reduced waste and improved strength-to-weight ratios. These innovations not only enhance the durability and efficiency of aircraft but also reduce production costs. As manufacturers continue to invest in research and development, the Commercial Aircraft Material Market is expected to benefit from a wave of new materials that could redefine aircraft design and functionality.