Commercial Aircraft Landing Gear Size

Market Size Snapshot

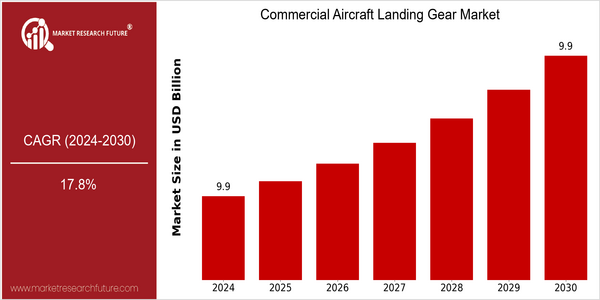

| Year | Value |

|---|---|

| 2024 | USD 9.88 Billion |

| 2030 | USD 9.88 Billion |

| CAGR (2023-2030) | 17.8 % |

Note – Market size depicts the revenue generated over the financial year

The Commercial Aircraft Landing Gear Market is poised for significant growth, with a current market size of USD 9.88 billion in 2024, projected to maintain the same value through 2030. This stability, coupled with a robust compound annual growth rate (CAGR) of 17.8% from 2023 to 2030, indicates a dynamic landscape driven by technological advancements and increasing demand for efficient aircraft operations. The market's resilience can be attributed to the ongoing modernization of aircraft fleets, where manufacturers are increasingly focusing on lightweight materials and innovative designs to enhance performance and reduce operational costs.

Key factors propelling this market include the rising global air traffic, which necessitates the expansion of commercial fleets, and the growing emphasis on safety and reliability in landing gear systems. Companies such as Safran Landing Systems, Collins Aerospace, and Liebherr Aerospace are at the forefront of this evolution, investing in research and development to introduce advanced landing gear technologies. Strategic initiatives, including partnerships and collaborations aimed at enhancing product offerings and expanding market reach, further underscore the competitive nature of this sector. As the industry adapts to new regulatory standards and sustainability goals, the Commercial Aircraft Landing Gear Market is expected to evolve, presenting opportunities for innovation and growth.

Regional Market Size

Regional Deep Dive

The Commercial Aircraft Landing Gear Market is characterized by a robust demand across various regions, driven by the increasing air travel and the expansion of the aviation sector. In North America, the market is bolstered by the presence of major aircraft manufacturers and a strong regulatory framework that emphasizes safety and innovation. Europe showcases a blend of established aerospace companies and emerging technologies, while the Asia-Pacific region is witnessing rapid growth due to rising passenger traffic and investments in new aircraft. The Middle East and Africa are also seeing developments driven by increasing air travel and infrastructure investments, while Latin America is gradually expanding its market presence as regional airlines modernize their fleets.

Europe

- The European Union Aviation Safety Agency (EASA) has been actively working on regulatory frameworks that promote the use of sustainable materials in landing gear manufacturing, aligning with the region's green initiatives.

- Airbus has launched several projects aimed at integrating smart technologies into landing gear systems, such as predictive maintenance solutions, which are expected to reduce downtime and operational costs for airlines.

Asia Pacific

- The region is experiencing a surge in demand for new aircraft, with countries like China and India investing heavily in their aviation infrastructure, leading to increased orders for landing gear systems.

- Local manufacturers, such as Hindustan Aeronautics Limited (HAL), are collaborating with global players to enhance their capabilities in landing gear production, which is expected to boost regional competitiveness.

Latin America

- Latin American airlines are increasingly focusing on fleet modernization, with several carriers announcing orders for new aircraft, which will drive the demand for advanced landing gear systems.

- Government initiatives aimed at improving aviation safety standards are encouraging local manufacturers to enhance their production capabilities and align with international standards.

North America

- The Federal Aviation Administration (FAA) has introduced new regulations aimed at enhancing the safety and performance of landing gear systems, which is prompting manufacturers to innovate and upgrade their products.

- Major companies like Boeing and Lockheed Martin are investing in advanced materials and technologies for landing gear systems, focusing on weight reduction and improved durability, which is expected to enhance operational efficiency.

Middle East And Africa

- The Middle East is witnessing significant investments in airport infrastructure, with projects like the expansion of Dubai International Airport, which is expected to increase the demand for advanced landing gear systems.

- Regional airlines are modernizing their fleets with new aircraft, leading to a higher demand for innovative landing gear solutions that can support larger and more efficient aircraft.

Did You Know?

“Did you know that the landing gear system accounts for approximately 10% of an aircraft's total weight, making its design and materials critical for overall aircraft performance?” — Aerospace Engineering Journal

Segmental Market Size

The Commercial Aircraft Landing Gear segment plays a crucial role in ensuring the safety and efficiency of aircraft operations, currently experiencing stable demand due to the ongoing recovery in air travel. Key drivers include the increasing focus on aircraft safety standards and advancements in materials technology, which enhance the performance and durability of landing gear systems. Additionally, regulatory policies mandating stricter safety compliance are propelling demand for innovative landing gear solutions.

Currently, the adoption stage of advanced landing gear technologies is in the scaled deployment phase, with companies like Boeing and Airbus leading the charge in integrating lightweight materials and smart technologies into their aircraft designs. Primary applications include commercial airliners and cargo aircraft, where efficient landing gear systems are essential for operational reliability. Trends such as sustainability initiatives are catalyzing growth, as manufacturers seek to reduce weight and improve fuel efficiency. Technologies like additive manufacturing and predictive maintenance tools are shaping the evolution of this segment, enabling more efficient production processes and enhanced lifecycle management.

Future Outlook

The Commercial Aircraft Landing Gear Market is poised for significant growth from 2024 to 2030, with a projected compound annual growth rate (CAGR) of 17.8%. This growth trajectory is expected to elevate the market value from $9.88 billion in 2024 to approximately $9.88 billion by 2030, reflecting a robust demand driven by the increasing global air traffic and the expansion of the commercial aviation sector. As airlines continue to modernize their fleets to enhance fuel efficiency and reduce operational costs, the adoption of advanced landing gear systems that incorporate lightweight materials and innovative designs will become increasingly prevalent.

Key technological advancements, such as the integration of smart landing gear systems equipped with sensors for real-time monitoring and predictive maintenance, are anticipated to reshape the market landscape. Additionally, stringent regulatory frameworks aimed at improving aircraft safety and performance will further propel the demand for high-quality landing gear solutions. Emerging trends, including the shift towards electric and hybrid aircraft, will also influence the market, as manufacturers seek to develop landing gear systems that align with the evolving needs of next-generation aircraft. Overall, the Commercial Aircraft Landing Gear Market is set to experience dynamic growth, driven by technological innovation and a favorable regulatory environment.

Leave a Comment