Consumer Preferences

Consumer preferences are evolving, significantly impacting the Coating Resins Market. There is a growing demand for high-quality, durable, and aesthetically pleasing coatings across various applications, including automotive, industrial, and architectural sectors. Consumers are increasingly favoring products that offer long-lasting performance and minimal maintenance. This trend is reflected in the rising popularity of advanced coating technologies, such as self-cleaning and anti-fingerprint coatings. In 2025, it is projected that the demand for premium coatings will drive a substantial portion of the market growth, potentially accounting for over 25% of the total sales in the Coating Resins Market. Manufacturers are thus compelled to innovate and enhance their product offerings to align with these changing consumer expectations.

Regulatory Compliance

Regulatory compliance is a critical driver for the Coating Resins Market. Governments worldwide are implementing stringent regulations to control emissions and ensure product safety. Compliance with these regulations often necessitates the reformulation of existing products, pushing manufacturers to innovate and adapt. For instance, the introduction of the European Union's REACH regulation has compelled companies to invest in safer and more sustainable resin formulations. This regulatory landscape not only influences product development but also creates opportunities for companies that can meet these standards effectively. As a result, the Coating Resins Market is likely to experience a shift towards more compliant and environmentally friendly products.

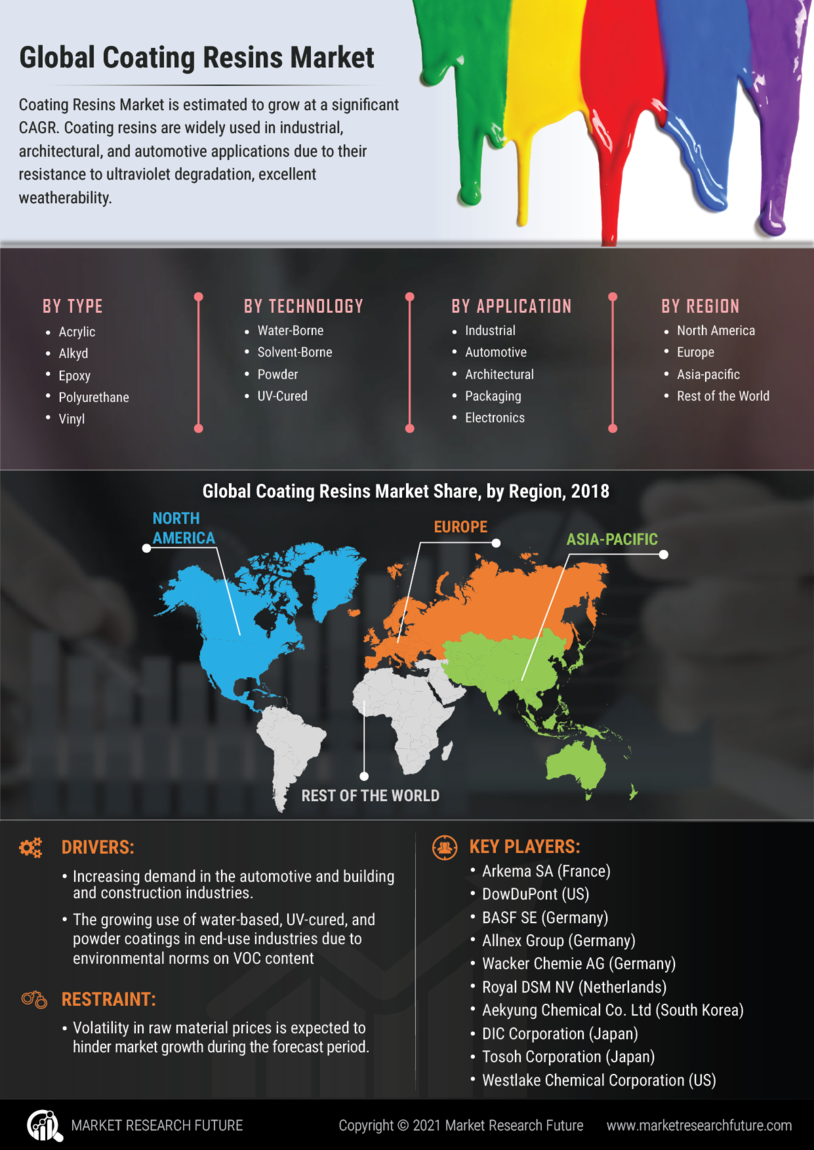

Emerging Market Growth

Emerging markets are becoming increasingly significant for the Coating Resins Market. Countries in Asia-Pacific and Latin America are experiencing rapid industrialization and urbanization, leading to heightened demand for coatings in construction, automotive, and consumer goods sectors. In 2025, it is anticipated that the Asia-Pacific region will account for nearly 40% of the total coating resins market share. This growth is further supported by rising disposable incomes and changing consumer preferences towards high-quality finishes. As manufacturers expand their operations in these regions, the Coating Resins Market is likely to see a surge in product offerings tailored to local needs, thereby enhancing market penetration.

Sustainability Initiatives

The Coating Resins Market is increasingly influenced by sustainability initiatives. Manufacturers are focusing on developing eco-friendly resins that minimize environmental impact. This shift is driven by stringent regulations aimed at reducing volatile organic compounds (VOCs) and promoting the use of renewable resources. As a result, the demand for water-based and bio-based coating resins is on the rise. In 2025, it is estimated that the market for sustainable coating solutions could account for over 30% of the total coating resins market. This trend not only aligns with consumer preferences for greener products but also encourages innovation in formulation technologies, thereby enhancing the competitive landscape of the Coating Resins Market.

Technological Advancements

Technological advancements play a pivotal role in shaping the Coating Resins Market. Innovations in polymer chemistry and formulation techniques have led to the development of high-performance resins that offer superior durability and aesthetic appeal. For instance, the introduction of nanotechnology in coatings has resulted in products with enhanced properties such as scratch resistance and UV stability. The market is projected to witness a compound annual growth rate (CAGR) of approximately 5% from 2025 to 2030, driven by these advancements. Furthermore, automation and digitalization in manufacturing processes are expected to improve efficiency and reduce production costs, thereby fostering growth within the Coating Resins Market.