Growing Focus on Data Center Optimization

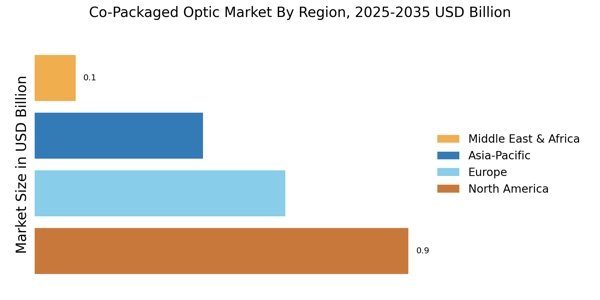

The Co-Packaged Optic Market is poised for growth due to the increasing emphasis on data center optimization. As organizations strive to enhance operational efficiency and reduce costs, the need for innovative solutions that minimize power consumption and maximize performance becomes critical. Co-packaged optics provide a means to achieve these objectives by reducing the physical footprint and energy requirements of data center operations. Recent analyses suggest that data centers account for a substantial portion of global energy consumption, prompting operators to seek more sustainable technologies. The adoption of co-packaged optics is likely to play a pivotal role in the ongoing transformation of data center environments.

Rising Demand for High-Speed Data Transmission

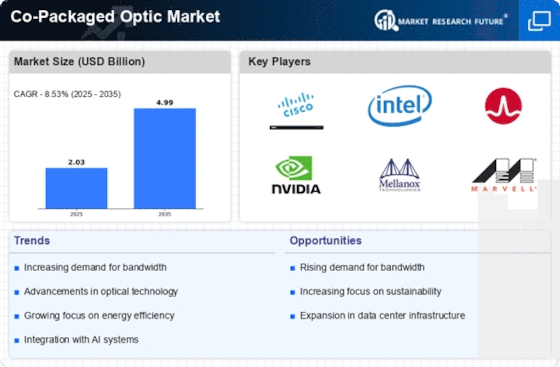

The Co-Packaged Optic Market is experiencing a surge in demand for high-speed data transmission solutions. As data consumption continues to escalate, driven by the proliferation of cloud computing and streaming services, the need for efficient data transfer mechanisms becomes paramount. Co-packaged optics, which integrate optical components with electronic circuits, offer a promising solution to meet these demands. According to recent estimates, the market for high-speed data transmission is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth is likely to propel the Co-Packaged Optic Market forward, as companies seek to enhance bandwidth and reduce latency in their networks.

Regulatory Support for Sustainable Technologies

The Co-Packaged Optic Market is likely to benefit from regulatory support aimed at promoting sustainable technologies. Governments and regulatory bodies are increasingly recognizing the importance of energy-efficient solutions in combating climate change. Co-packaged optics, which offer reduced energy consumption compared to traditional optical systems, align well with these sustainability goals. Incentives and policies encouraging the adoption of energy-efficient technologies are expected to create a favorable landscape for the Co-Packaged Optic Market. As organizations strive to comply with environmental regulations, the demand for co-packaged optics may see a notable increase, further driving market growth.

Advancements in Telecommunications Infrastructure

The Co-Packaged Optic Market is significantly influenced by advancements in telecommunications infrastructure. As telecommunications companies upgrade their networks to support 5G and beyond, the integration of co-packaged optics becomes increasingly relevant. These technologies facilitate higher data rates and improved signal integrity, which are essential for modern communication systems. The ongoing investments in fiber optic networks and the transition to more efficient architectures are expected to drive the adoption of co-packaged optics. Reports indicate that the telecommunications sector is set to invest billions in infrastructure upgrades, thereby creating a favorable environment for the Co-Packaged Optic Market to thrive.

Emergence of Artificial Intelligence and Machine Learning

The Co-Packaged Optic Market is being shaped by the emergence of artificial intelligence (AI) and machine learning (ML) technologies. These advancements necessitate the processing of vast amounts of data at unprecedented speeds, which co-packaged optics can facilitate. By integrating optical components directly with electronic systems, co-packaged optics can significantly enhance data throughput and processing capabilities. The increasing reliance on AI and ML across various sectors, including finance, healthcare, and manufacturing, is expected to drive demand for high-performance optical solutions. As organizations seek to leverage these technologies, the Co-Packaged Optic Market stands to benefit from this trend.