Rising Demand for Clean Water

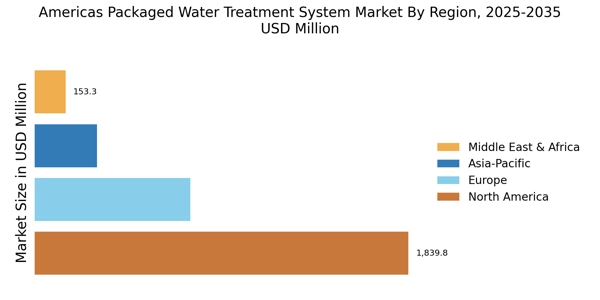

The increasing demand for clean and safe drinking water in North America is a primary driver for the packaged water-treatment-system market. As urban populations grow, the pressure on existing water resources intensifies, leading to a heightened focus on water quality. According to recent data, approximately 15% of households in North America rely on bottled water as their primary source of drinking water. This trend indicates a significant market opportunity for packaged water-treatment systems, which can provide efficient solutions for both residential and commercial applications. The packaged water-treatment-system market is poised to benefit from this rising demand, as consumers seek reliable and effective methods to ensure water safety and quality.

Growing Awareness of Health Issues

Health concerns related to water quality are increasingly influencing consumer choices in North America. The packaged water-treatment-system market is experiencing growth as individuals become more aware of the potential health risks associated with contaminated water. Reports indicate that nearly 30% of consumers are willing to invest in water treatment solutions to mitigate these risks. This trend is particularly evident in areas with known water quality issues, where the demand for effective treatment systems is on the rise. As public awareness continues to grow, the packaged water-treatment-system market is likely to expand, driven by the need for safe and healthy drinking water.

Regulatory Pressures and Compliance

Regulatory pressures are a significant driver for the packaged water-treatment-system market in North America. Stricter regulations regarding water quality and safety are prompting municipalities and businesses to invest in advanced treatment systems. The Environmental Protection Agency (EPA) has established stringent guidelines that require compliance, leading to an increased focus on effective water treatment solutions. The packaged water-treatment-system market is likely to benefit from these regulatory changes, as organizations seek to meet compliance standards while ensuring the safety of their water supply. This trend not only drives demand for packaged systems but also encourages innovation in the development of compliant technologies.

Increased Investment in Infrastructure

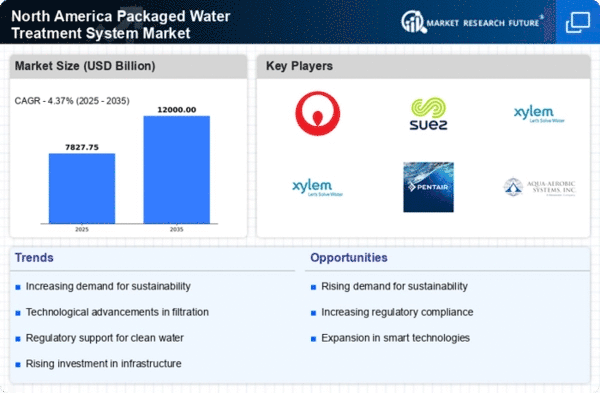

Investment in water infrastructure is crucial for the packaged water-treatment-system market. North America has seen a surge in funding for water treatment facilities, with an estimated $100 billion allocated for upgrades and new projects over the next decade. This investment is driven by the need to replace aging infrastructure and meet stricter water quality standards. The packaged water-treatment-system market stands to gain from these developments, as municipalities and private entities look for innovative solutions to enhance water treatment capabilities. Furthermore, the integration of advanced technologies in these systems can lead to improved efficiency and reduced operational costs, making them an attractive option for stakeholders.

Technological Innovations in Water Treatment

Technological advancements are reshaping the packaged water-treatment-system market. Innovations such as membrane filtration, UV disinfection, and advanced oxidation processes are enhancing the efficiency and effectiveness of water treatment systems. The market is witnessing a shift towards smart water treatment solutions that offer real-time monitoring and automated controls. These technologies not only improve water quality but also reduce energy consumption and operational costs. As North American consumers and businesses increasingly seek out cutting-edge solutions, the packaged water-treatment-system market is expected to thrive, driven by the demand for more efficient and sustainable water treatment options.