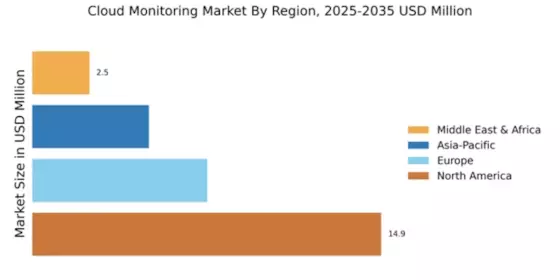

Market Growth Projections

The Global Cloud Monitoring Market Industry is poised for substantial growth, with projections indicating a market size of 30 USD Billion in 2024 and an anticipated increase to 75 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 8.69% from 2025 to 2035. The increasing adoption of cloud services, coupled with the rising demand for security and compliance, positions the industry for a robust expansion. As organizations continue to embrace digital transformation, the need for effective cloud monitoring solutions will likely remain a critical focus for businesses worldwide.

Growth of IoT and Edge Computing

The proliferation of Internet of Things (IoT) devices and the rise of edge computing are significant factors influencing the Global Cloud Monitoring Market Industry. As IoT adoption accelerates, the volume of data generated necessitates robust monitoring solutions to ensure seamless connectivity and performance. Edge computing further complicates monitoring needs, as data processing occurs closer to the source. Organizations require sophisticated tools to monitor distributed environments effectively. This trend is expected to drive substantial growth in the market, as businesses seek to harness the benefits of IoT and edge technologies while maintaining optimal performance.

Rising Demand for Cloud Services

The Global Cloud Monitoring Market Industry experiences a surge in demand for cloud services as businesses increasingly migrate to cloud-based solutions. This shift is driven by the need for scalability, flexibility, and cost-effectiveness. In 2024, the market is projected to reach 30 USD Billion, reflecting the growing reliance on cloud infrastructure. Organizations are seeking robust monitoring tools to ensure optimal performance and security of their cloud environments. As more enterprises adopt multi-cloud strategies, the necessity for comprehensive monitoring solutions becomes paramount, indicating a strong growth trajectory for the industry.

Emergence of Hybrid Cloud Solutions

The emergence of hybrid cloud solutions is reshaping the landscape of the Global Cloud Monitoring Market Industry. Organizations are increasingly adopting hybrid models to leverage the benefits of both public and private clouds. This complexity necessitates advanced monitoring tools capable of providing visibility across diverse environments. As businesses strive for operational efficiency and cost savings, the demand for comprehensive monitoring solutions that can seamlessly integrate with hybrid infrastructures is likely to grow. This trend aligns with the overall market growth, with projections indicating a significant increase in market size over the coming years.

Increased Focus on Security and Compliance

Security and compliance concerns are pivotal drivers in the Global Cloud Monitoring Market Industry. As organizations store sensitive data in the cloud, the demand for monitoring solutions that ensure data integrity and regulatory compliance intensifies. Companies are investing in advanced monitoring tools to detect anomalies, mitigate risks, and comply with regulations such as GDPR and HIPAA. This heightened focus on security is expected to propel the market, with projections indicating a growth to 75 USD Billion by 2035. The integration of AI and machine learning in monitoring solutions further enhances security measures, making them indispensable for businesses.

Adoption of Artificial Intelligence and Automation

The integration of artificial intelligence and automation technologies is transforming the Global Cloud Monitoring Market Industry. AI-driven monitoring solutions provide real-time insights and predictive analytics, enabling organizations to proactively address performance issues. Automation streamlines monitoring processes, reducing the need for manual intervention and enhancing operational efficiency. As businesses increasingly rely on data-driven decision-making, the demand for intelligent monitoring tools is likely to rise. This trend is anticipated to contribute to a compound annual growth rate of 8.69% from 2025 to 2035, underscoring the potential for innovation within the industry.