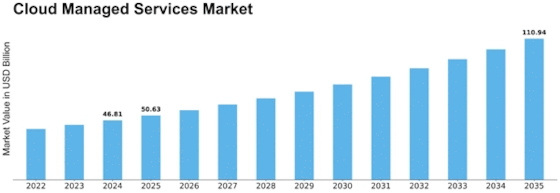

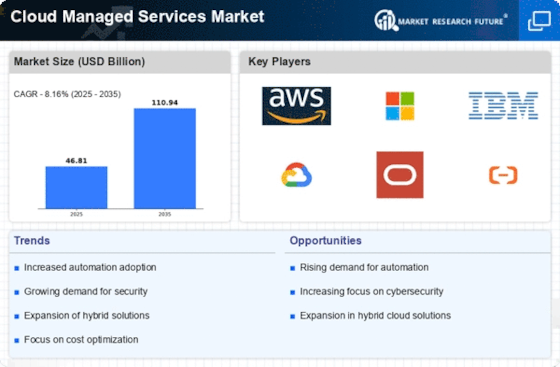

Cloud Managed Services Size

Cloud Managed Services Market Growth Projections and Opportunities

Many variables drive the Cloud Managed Services Market's dynamics and development. These market factors include rising need for efficient and scalable IT infrastructure. Expertly managed services are essential as organizations go to the cloud. Cloud solutions' cost-effectiveness and flexibility are encouraging organizations to use managed services to concentrate on core capabilities and outsource cloud infrastructure maintenance. Additionally, fast technology improvements shape the industry. Cloud managed services are evolving due to advances in cloud computing technologies like AI, machine learning, and IoT. These technologies improve cloud service performance and allow predictive analytics and proactive management, improving cloud-based operations. The competitive landscape also shapes cloud managed services market aspects. New and improved services are introduced to differentiate suppliers as they compete for market share. This competition encourages innovation and forces suppliers to improve their services, ensuring customers have access to cutting-edge solutions that fit their changing demands. Another major issue affecting cloud managed services is security. Businesses value cloud infrastructure security as cyber attacks become more frequent and sophisticated. Managed service companies who provide data encryption, threat detection, and regular security audits have a competitive advantage. Cloud scalability and flexibility drive managed service adoption. Businesses now need flexible systems that can scale up or down and respond to changing needs. Cloud managed services offer the infrastructure and support for scalability, helping enterprises match IT resources with business goals. Businesses in all sectors worry about regulatory compliance. Service providers' regulatory compliance affects the cloud managed services industry. Customers trust providers that comply with data privacy laws, industry standards, and other rules, especially in highly regulated industries like banking and healthcare. Businesses considering cloud managed services want cost efficiency. Moving from CapEx to OpEx motivates IT budget optimization. Cloud managed services allow enterprises to pay just for what they need, eliminating huge infrastructure costs. The geography also affects cloud managed service market aspects. Cloud adoption maturity varies by area due to infrastructure development, economic circumstances, and regulations. As enterprises globally grasp the advantages of cloud services, demand for cloud managed services grows, with geographical differences impacting service types and scope. Market trends depend on customer choices and expectations. SLAs, customer support, and the capacity to modify services become critical differentiators as firms grow more selective in their managed service provider choices. Offering a smooth and customized experience to customers is likely to lead to market success.

Leave a Comment