Emergence of Startups and SMEs

The cloud managed-services market in India is significantly impacted by the emergence of startups and small to medium enterprises (SMEs). These entities are increasingly adopting cloud solutions to scale their operations without the burden of heavy upfront investments in infrastructure. The startup ecosystem in India is thriving, with thousands of new ventures being established each year, many of which rely on cloud managed services for their IT needs. This trend is expected to contribute to the growth of the cloud managed-services market, as startups and SMEs seek cost-effective and flexible solutions to enhance their competitiveness. The agility offered by cloud services allows these businesses to innovate rapidly, further driving the demand for managed services tailored to their unique requirements.

Increased Focus on Data Analytics

In the context of the cloud managed-services market, the growing emphasis on data analytics is a critical driver. Organizations in India are recognizing the value of data-driven decision-making, leading to an increased reliance on cloud-based analytics solutions. The market for big data analytics is expected to grow at a CAGR of over 25% in the coming years, reflecting the urgency for businesses to harness their data effectively. Cloud managed services play a vital role in this ecosystem, providing the necessary infrastructure and expertise to analyze vast amounts of data efficiently. As companies strive to gainsights and improve their operational strategies, the cloud managed-services market is likely to see heightened demand for analytics-driven solutions, further solidifying its importance in the digital landscape.

Expansion of Internet Connectivity

The cloud managed-services market in India is poised for growth due to the expansion of internet connectivity across the country. With the increasing penetration of high-speed internet, more businesses are able to leverage cloud technologies. Reports indicate that internet penetration in India is expected to reach 800 million users by 2025, creating a fertile ground for cloud adoption. This enhanced connectivity facilitates the seamless delivery of managed services, allowing organizations to access cloud resources and applications more efficiently. As businesses recognize the advantages of cloud solutions, the cloud managed-services market is likely to experience a surge in demand, driven by the need for reliable and accessible cloud services that can support their operations.

Rising Demand for Digital Transformation

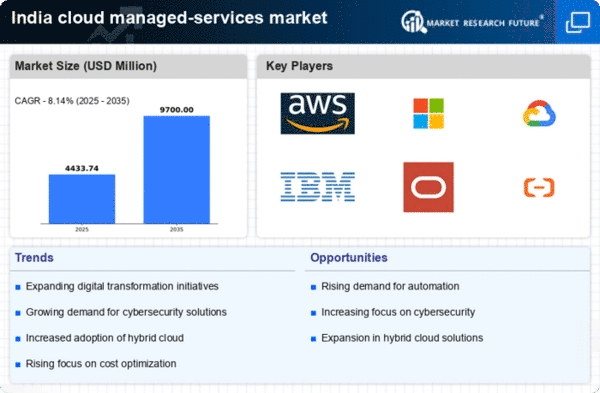

The cloud managed-services market in India experiences a notable surge in demand driven by the ongoing digital transformation across various sectors. Organizations are increasingly adopting cloud solutions to enhance operational efficiency and agility. According to recent data, the Indian cloud market is projected to reach approximately $10 billion by 2025, indicating a robust growth trajectory. This transformation is not merely a trend but a necessity for businesses aiming to remain competitive in a rapidly evolving landscape. As companies migrate to cloud platforms, the need for managed services becomes paramount, facilitating seamless integration and management of cloud resources. The cloud managed-services market is thus positioned to benefit significantly from this shift, as enterprises seek expert guidance to navigate the complexities of cloud adoption.

Growing Importance of Disaster Recovery Solutions

The cloud managed-services market in India is significantly influenced by the increasing recognition of disaster recovery solutions. Businesses are becoming more aware of the potential risks associated with data loss and system failures, prompting them to invest in robust disaster recovery strategies. The market for disaster recovery as a service (DRaaS) is anticipated to grow substantially, with estimates suggesting a CAGR of around 30% over the next few years. This growth is indicative of the cloud managed-services market's role in providing reliable and scalable recovery solutions that ensure business continuity. As organizations prioritize resilience and risk management, the demand for managed services that specialize in disaster recovery is likely to rise, further enhancing the market's relevance.