Cost Efficiency and Scalability

Cost efficiency remains a pivotal driver in the Cloud High-Performance Computing Market. Organizations are increasingly shifting from traditional on-premises HPC systems to cloud-based solutions to reduce capital expenditures associated with hardware and maintenance. The pay-as-you-go model offered by cloud providers allows businesses to scale their computing resources according to demand, optimizing operational costs. This flexibility is particularly appealing to small and medium-sized enterprises that may lack the resources for extensive IT infrastructure. Market analysis indicates that the transition to cloud HPC can lead to cost savings of up to 30%, making it an attractive option for organizations looking to enhance their computational capabilities without incurring significant financial burdens.

Advancements in Cloud Infrastructure

Technological advancements in cloud infrastructure are significantly influencing the Cloud High-Performance Computing Market. Innovations in networking, storage, and processing capabilities are enabling cloud providers to offer more robust and efficient HPC solutions. The introduction of high-speed interconnects and improved data transfer rates enhances the performance of cloud-based HPC systems, making them more competitive with traditional on-premises solutions. Furthermore, the integration of cutting-edge hardware, such as GPUs and FPGAs, is facilitating faster computations and more complex simulations. As these advancements continue to evolve, they are likely to attract more organizations to adopt cloud HPC, thereby expanding the market.

Increased Collaboration and Partnerships

Increased collaboration and partnerships among technology providers are shaping the Cloud High-Performance Computing Market. Cloud service providers are forming strategic alliances with hardware manufacturers, software developers, and research institutions to enhance their HPC offerings. These collaborations aim to create integrated solutions that combine the strengths of various technologies, thereby improving performance and usability. For example, partnerships that focus on developing specialized software for specific industries can lead to more tailored HPC solutions. This trend not only fosters innovation but also expands the reach of cloud HPC services, as organizations are more likely to adopt solutions that are specifically designed to meet their unique needs.

Growing Focus on Research and Development

The Cloud High-Performance Computing Market is witnessing a growing emphasis on research and development across various fields. Academic institutions and research organizations are increasingly utilizing cloud HPC to conduct simulations, modeling, and data analysis, which are essential for scientific breakthroughs. This trend is supported by government initiatives that promote the use of advanced computing technologies in research. For instance, funding programs aimed at enhancing computational resources for research projects are becoming more prevalent. As a result, the demand for cloud HPC services is expected to rise, as researchers seek to leverage the power of cloud computing to accelerate their work and achieve innovative outcomes.

Rising Demand for Data-Intensive Applications

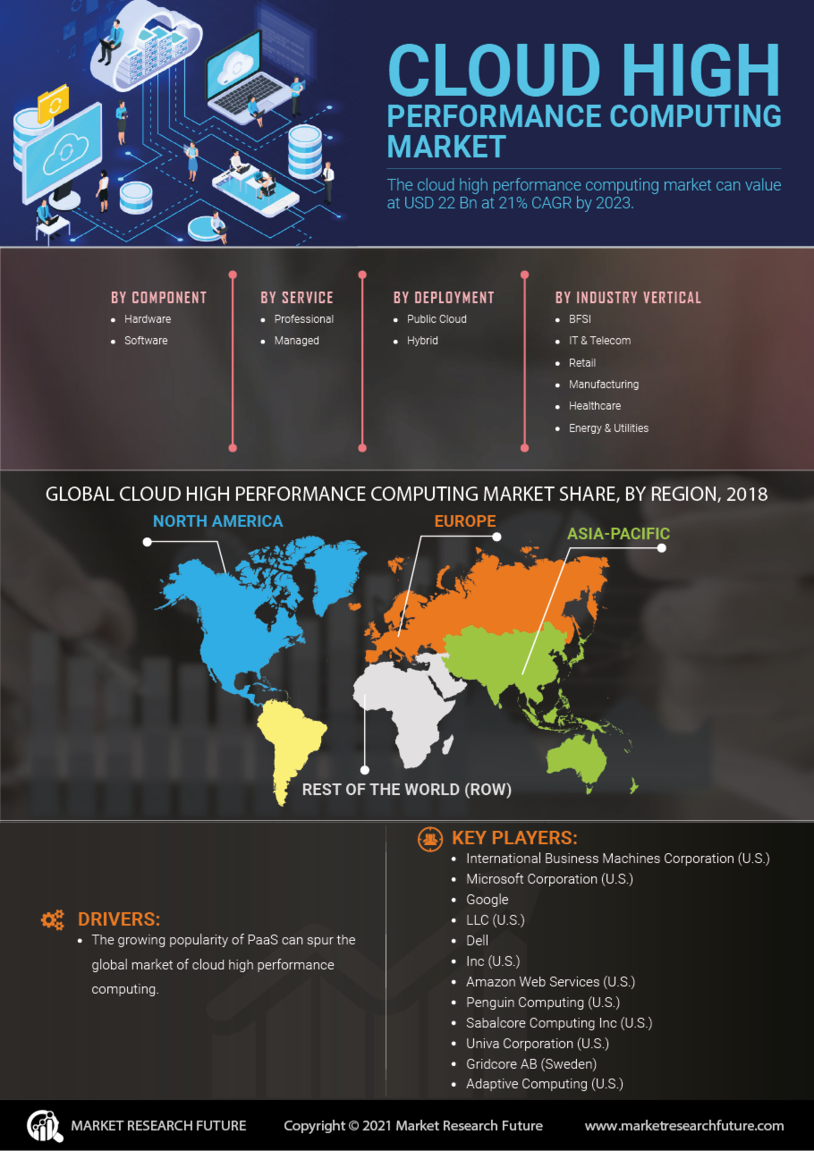

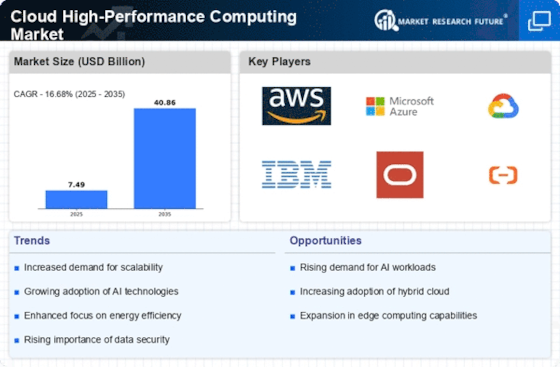

The Cloud High-Performance Computing Market is experiencing a surge in demand for data-intensive applications across various sectors. Industries such as finance, healthcare, and scientific research are increasingly relying on high-performance computing (HPC) to process vast amounts of data efficiently. This trend is driven by the need for real-time analytics and complex simulations, which require substantial computational power. According to recent estimates, the HPC market is projected to grow at a compound annual growth rate (CAGR) of over 7% through the next few years. As organizations seek to leverage big data for strategic decision-making, the adoption of cloud-based HPC solutions is likely to accelerate, further propelling the market forward.