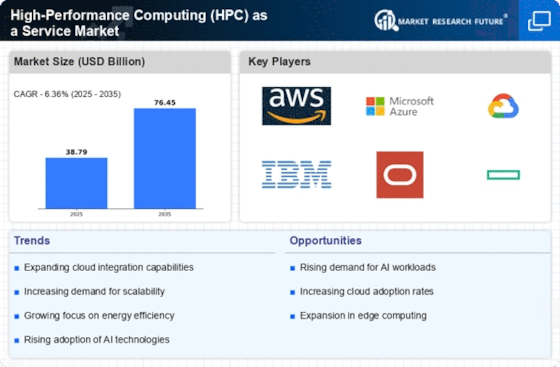

Advancements in Cloud Technology

Technological advancements in cloud computing infrastructure are significantly influencing the High-Performance Computing (HPC) as a Service Market. The evolution of cloud technologies, including improved storage solutions and faster networking capabilities, enables organizations to access HPC resources without the need for substantial upfront investments. This shift towards cloud-based HPC solutions allows for greater flexibility and scalability, catering to the varying computational needs of businesses. As organizations increasingly adopt hybrid cloud models, the HPC market is expected to witness a notable increase in service adoption. The ability to leverage cloud resources for high-performance computing tasks is likely to enhance productivity and reduce time-to-market for various applications.

Cost-Effectiveness of HPC Solutions

The cost-effectiveness of High-Performance Computing (HPC) as a Service Market solutions is becoming increasingly appealing to organizations. Traditional HPC setups often require significant capital investment in hardware and maintenance, which can be prohibitive for many businesses. In contrast, HPC as a service offers a pay-as-you-go model, allowing organizations to access high-performance computing resources without the burden of upfront costs. This financial flexibility is particularly attractive to small and medium-sized enterprises that may lack the resources for extensive infrastructure. As the market continues to evolve, the cost advantages of HPC services are likely to drive wider adoption, enabling more organizations to leverage advanced computing capabilities for their operations.

Growing Focus on Research and Development

A heightened emphasis on research and development across multiple sectors is driving the High-Performance Computing (HPC) as a Service Market. Organizations are investing significantly in R&D to foster innovation and maintain competitive advantages. This trend is particularly evident in sectors such as pharmaceuticals, aerospace, and automotive, where complex simulations and modeling are essential. The HPC market is projected to benefit from this focus, as R&D activities often require substantial computational power. As a result, the demand for HPC services is expected to rise, with organizations seeking to leverage these capabilities to accelerate their research initiatives and bring products to market more efficiently.

Increased Adoption of Artificial Intelligence

The integration of artificial intelligence (AI) into various business processes is emerging as a key driver for the High-Performance Computing (HPC) as a Service Market. AI applications often require extensive computational resources for training and inference, which HPC services can provide. As organizations increasingly adopt AI technologies, the demand for HPC solutions is likely to grow. This trend is underscored by the fact that the AI market is anticipated to reach substantial valuations in the coming years, further propelling the need for HPC capabilities. The synergy between AI and HPC is expected to create new opportunities for service providers, as businesses seek to harness the power of both technologies to drive innovation.

Rising Demand for Data-Intensive Applications

The increasing reliance on data-intensive applications across various sectors appears to be a primary driver for the High-Performance Computing (HPC) as a Service Market. Industries such as finance, healthcare, and scientific research are generating vast amounts of data that necessitate advanced computational capabilities. As organizations seek to harness this data for insights and decision-making, the demand for HPC services is likely to surge. According to recent estimates, the HPC market is projected to grow at a compound annual growth rate of over 7% through the next few years, indicating a robust appetite for high-performance solutions. This trend suggests that businesses are increasingly recognizing the value of HPC as a service to enhance their operational efficiency and innovation.