Rising Awareness of Food Safety

The clean label mold inhibitor Market is significantly influenced by the rising awareness of food safety among consumers. As foodborne illnesses and contamination issues gain more attention, consumers are becoming increasingly cautious about the products they purchase. This heightened awareness has led to a preference for clean label products that are perceived as safer and healthier. Manufacturers are responding to this trend by incorporating clean label mold inhibitors that not only extend shelf life but also ensure the safety of food products. The emphasis on food safety is likely to continue shaping consumer preferences, thereby propelling the growth of the Clean Label Mold Inhibitor Market.

Innovation in Clean Label Technologies

Innovation plays a crucial role in the Clean Label Mold Inhibitor Market, as companies are increasingly investing in research and development to create effective and natural mold inhibitors. Advances in technology have led to the discovery of new natural ingredients that can effectively inhibit mold growth without compromising product quality. This innovation not only addresses consumer concerns regarding artificial additives but also enhances the overall efficacy of mold inhibitors. As a result, the Clean Label Mold Inhibitor Market is witnessing a wave of new product launches that cater to the demand for clean label solutions. The introduction of these innovative products is likely to attract a broader consumer base, further driving market growth.

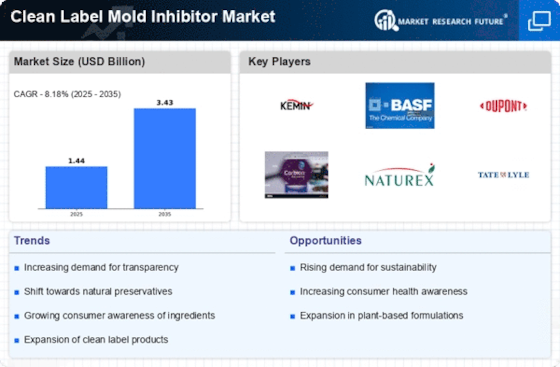

Consumer Demand for Clean Label Products

The Clean Label Mold Inhibitor Market is experiencing a notable surge in consumer demand for products that are perceived as natural and free from artificial additives. This trend is driven by an increasing awareness of health and wellness among consumers, who are more inclined to scrutinize ingredient lists. According to recent surveys, a significant percentage of consumers express a preference for clean label products, which has prompted manufacturers to reformulate their offerings. This shift not only enhances product appeal but also aligns with the growing trend of transparency in food labeling. As a result, companies are investing in clean label mold inhibitors that meet these consumer expectations, thereby driving growth in the Clean Label Mold Inhibitor Market.

Sustainability Trends in Food Production

Sustainability is becoming a pivotal factor in the Clean Label Mold Inhibitor Market, as consumers and manufacturers alike prioritize environmentally friendly practices. The demand for sustainable food production methods is driving the adoption of clean label mold inhibitors that align with these values. Companies are increasingly seeking natural and biodegradable ingredients that not only inhibit mold growth but also minimize environmental impact. This trend is reflected in the growing number of certifications and labels that emphasize sustainability in food products. As consumers continue to favor brands that demonstrate a commitment to sustainability, the Clean Label Mold Inhibitor Market is likely to experience robust growth, fueled by the integration of sustainable practices.

Regulatory Support for Clean Label Standards

The Clean Label Mold Inhibitor Market is benefiting from a favorable regulatory environment that increasingly supports clean label standards. Governments and regulatory bodies are recognizing the importance of consumer safety and transparency, leading to the establishment of guidelines that promote the use of natural ingredients. This regulatory support encourages manufacturers to adopt clean label practices, as compliance with these standards can enhance brand reputation and consumer trust. Furthermore, the implementation of stricter regulations on artificial preservatives and additives is likely to propel the demand for clean label mold inhibitors. As companies strive to meet these evolving regulations, the Clean Label Mold Inhibitor Market is poised for substantial growth.