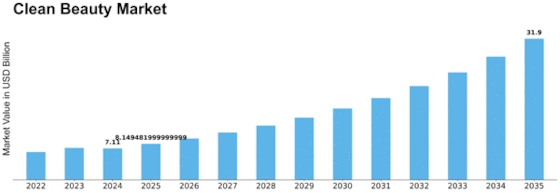

Clean Beauty Size

Clean Beauty Market Growth Projections and Opportunities

The clean beauty market is influenced by several dynamic factors that drive its growth, trends, and consumer preferences. One significant factor shaping the dynamics of the clean beauty market is the increasing consumer demand for safer, more transparent, and environmentally friendly beauty products. As awareness grows about the potential health risks associated with certain synthetic ingredients commonly found in cosmetics, skincare, and personal care products, consumers are seeking out cleaner alternatives made from natural, non-toxic, and ethically sourced ingredients. This heightened concern for ingredient safety and transparency has propelled the clean beauty movement, driving demand for clean beauty products that prioritize ingredient integrity, sustainability, and environmental responsibility.

Moreover, market dynamics within the clean beauty industry are influenced by changing consumer attitudes and lifestyle choices. Millennials and Gen Z consumers, in particular, are driving demand for clean beauty products, as they prioritize health, wellness, and sustainability in their purchasing decisions. These younger generations are more informed and socially conscious, seeking out brands and products that align with their values of transparency, authenticity, and ethical practices. As a result, clean beauty brands are gaining traction and market share, appealing to a diverse range of consumers who value clean, safe, and effective beauty solutions.

Furthermore, advancements in technology and innovation drive market dynamics within the clean beauty industry. Clean beauty brands leverage scientific research, natural formulations, and cutting-edge technologies to develop clean, effective, and high-performing beauty products that deliver visible results without compromising on safety or sustainability. From plant-based ingredients and biodegradable packaging to clean formulations and cruelty-free testing methods, technological advancements enable clean beauty brands to innovate and differentiate themselves in a competitive market landscape.

Supply chain dynamics and sourcing practices also impact market dynamics within the clean beauty industry. Clean beauty brands prioritize ethical sourcing, fair trade practices, and sustainable supply chains to ensure the integrity and traceability of their ingredients. This includes sourcing raw materials from reputable suppliers, supporting local communities, and investing in eco-friendly farming and production methods. Additionally, clean beauty brands often undergo third-party certifications and audits to verify ingredient purity, safety, and sustainability, providing consumers with assurance and confidence in the integrity of their products.

Additionally, marketing and branding play a crucial role in shaping market dynamics within the clean beauty industry. Clean beauty brands leverage storytelling, authenticity, and brand transparency to connect with consumers and communicate their values and mission. Brand messaging that emphasizes ingredient transparency, sustainability initiatives, and social responsibility resonates with consumers who prioritize clean beauty and environmental stewardship. Moreover, influencer partnerships, social media campaigns, and community engagement initiatives help clean beauty brands build brand awareness, foster brand loyalty, and drive consumer engagement within the clean beauty community.

Regulatory standards and industry regulations also impact market dynamics in the clean beauty industry. Clean beauty brands must comply with regulations related to product safety, labeling, and advertising to ensure the safety and integrity of their products. Additionally, clean beauty brands often adhere to third-party certifications and standards, such as the Environmental Working Group's (EWG) Verified program, the Leaping Bunny certification for cruelty-free products, and the USDA Organic certification for organic products, to validate their clean beauty claims and differentiate themselves in the marketplace.

Consumer education and awareness are also significant drivers of market dynamics within the clean beauty industry. As consumers become more informed about the potential health risks associated with certain ingredients commonly found in beauty products, they seek out clean beauty alternatives that offer safer and more sustainable options. Clean beauty brands play a crucial role in educating consumers about ingredient safety, environmental impact, and the benefits of clean beauty, empowering consumers to make informed purchasing decisions and adopt cleaner, more sustainable beauty routines.

Leave a Comment