Research Methodology on Fragrance Market

Introduction

Research methodology is one of the most important sections of a research report. It outlines the range of methods and procedures utilized for conducting research. Research methodology also describes the exact methods used for data collection and analysis. Research methodology is a crucial part of a research report as it plays a vital role in providing knowledge and accuracy to the research findings. This is why it is significant that the research methodology used in conducting the research is comprehensive and detailed enough to provide sufficient data points.

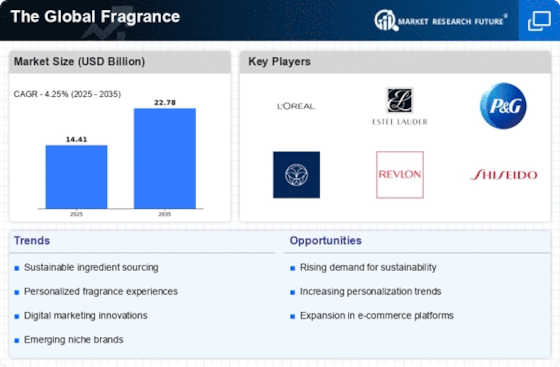

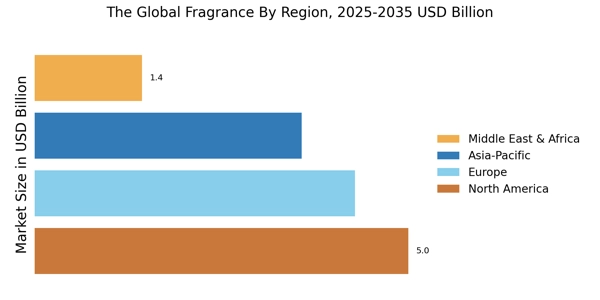

The current research re-addresses and analyses the global fragrance market, tracking regional fragrances market growth, opportunities, regional and country-level markets and PESTLE analysis.

The following research methodology will be used to conduct the research.

Research Design

The research design used in this project is the exploratory research design. Exploratory research provides an overview and introduction to the problem to gain a more deep insight into the research topic. Exploratory research studies are used to find the problem and help in the definition and the formation of the hypothesis. This research design helps to develop a better understanding of the problem and provides the researcher with a general overview of the topic.

Secondary Research

Secondary research is an important method of research which is used as an aid to primary research and provides data which can be used to conclude. This method of research is used to gain insight into the research topic and better understand the current points of view held in the industry. For example, the research can use journals, textbooks, industry reports, and online sources to gain a better understanding of the research topic.

Primary Research

Primary research is used to collect data which can answer the research questions posed by the researcher. Primary research consists of collecting data from primary sources such as interviews and surveys conducted with industry experts and potential customers. The primary research method also includes conducting focus groups and experiments to gain insights into the problem.

Sampling

After gathering the data from primary and secondary sources, the sample size will be determined based on the desired accuracy for the research. The sample size will depend on the nature of the research, the budget, and the timeframe. The sample size chosen should be large enough to provide a good representation of the target population while also being able to give accurate data points.

Data Collection

The data collection technique used in this research includes interviews, surveys, focus groups and other qualitative methods. Interviews and surveys will be conducted to gain insight into the fragrance market. The interviewees will include industry experts, potential customers and other experts who know the fragrance market.

Data Analysis

The data analysis focuses on answering the research questions and forming a clear insight into the perfume market. The data analysis techniques used will include descriptive statistics such as percentages and frequency distributions to analyze the data collected from the interviews and surveys. The data collected from the secondary sources are analyzed using the PESTLE framework and the data collected from the primary sources are analyzed using qualitative methods such as content analysis.

Data Validity

In order to ensure that the data is valid, the data which is collected from the primary and secondary sources will be verified and cross-referenced with other sources. This will help to ensure that the data is accurate and reliable.

Conclusion

The research methodology outlined in this research report is comprehensive and allows for the research to be conducted thoroughly and effectively. The research design, data collection methods, sampling and data analysis are all detailed clearly to provide a holistic overview of the research. The data validity outlined in this research helps to ensure that the data collected is reliable and accurate.