Rising Geriatric Population

The increasing geriatric population is a significant factor propelling the Cholinesterase Inhibitors Market. As individuals age, the risk of developing neurodegenerative diseases escalates, leading to a higher demand for effective treatment options. The World Health Organization projects that the number of people aged 60 years and older will reach 2 billion by 2050, which is likely to result in a surge in the prevalence of Alzheimer's and other related disorders. This demographic shift necessitates the availability of cholinesterase inhibitors, as they are often prescribed to manage cognitive decline in elderly patients. Consequently, pharmaceutical companies are expected to focus on developing new formulations and improving existing ones to cater to this growing population, thereby driving market growth.

Regulatory Support for Drug Approvals

Regulatory support for the approval of new cholinesterase inhibitors is fostering growth in the Cholinesterase Inhibitors Market. Regulatory agencies are increasingly recognizing the need for effective treatments for neurodegenerative diseases, leading to streamlined approval processes for innovative drugs. Initiatives aimed at expediting the review of new therapies, such as the FDA's Breakthrough Therapy designation, encourage pharmaceutical companies to invest in research and development. This supportive regulatory environment not only facilitates the introduction of new cholinesterase inhibitors but also enhances competition within the market. As more treatment options become available, patients benefit from improved access to medications, which is likely to further stimulate market demand.

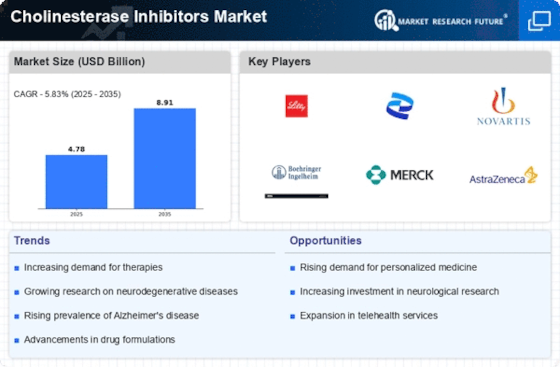

Increasing Prevalence of Alzheimer's Disease

The rising incidence of Alzheimer's disease is a primary driver for the Cholinesterase Inhibitors Market. As the population ages, the number of individuals diagnosed with Alzheimer's is expected to increase significantly. According to recent estimates, nearly 6 million people in the United States are living with Alzheimer's, and this number is projected to rise to 14 million by 2060. This growing patient population necessitates effective treatment options, thereby propelling the demand for cholinesterase inhibitors, which are commonly prescribed to manage symptoms. The increasing awareness and diagnosis of Alzheimer's also contribute to the market's expansion, as more patients seek medical intervention. Consequently, pharmaceutical companies are likely to invest in research and development to create innovative cholinesterase inhibitors, further stimulating market growth.

Technological Advancements in Drug Development

Technological innovations in drug development are significantly influencing the Cholinesterase Inhibitors Market. The advent of advanced drug delivery systems and novel formulation techniques has enhanced the efficacy and safety profiles of cholinesterase inhibitors. For instance, the use of nanotechnology in drug formulation has shown promise in improving bioavailability and reducing side effects. Furthermore, the integration of artificial intelligence in drug discovery processes is expediting the identification of potential cholinesterase inhibitors, thereby shortening the time to market. As a result, pharmaceutical companies are increasingly adopting these technologies to develop more effective treatments for neurodegenerative diseases. This trend not only boosts the competitive landscape but also attracts investments, which are crucial for the sustained growth of the cholinesterase inhibitors market.

Growing Awareness of Neurodegenerative Disorders

The increasing awareness of neurodegenerative disorders among healthcare professionals and the general public is driving the Cholinesterase Inhibitors Market. Educational campaigns and initiatives aimed at highlighting the symptoms and treatment options for conditions like Alzheimer's and Parkinson's disease have led to earlier diagnosis and intervention. This heightened awareness encourages patients and caregivers to seek medical advice, resulting in a higher prescription rate of cholinesterase inhibitors. Moreover, healthcare providers are more informed about the benefits of these medications, which further supports their use in clinical practice. As awareness continues to grow, it is anticipated that the demand for cholinesterase inhibitors will rise, thereby contributing to the overall market expansion.