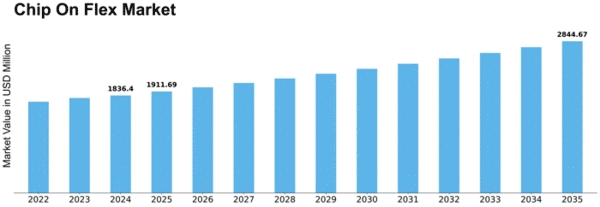

Chip On Flex Size

Chip On Flex Market Growth Projections and Opportunities

The Chip On Flex (COF) market is a dynamic sector influenced by various market factors that play a crucial role in shaping its growth and trajectory. One of the primary drivers of the COF market is the increasing demand for compact and lightweight electronic devices. As consumers continue to seek smaller and more portable gadgets, the need for flexible and space-saving solutions becomes paramount. COF technology, with its ability to integrate chips onto flexible substrates, addresses this demand effectively.

Furthermore, the rapid advancements in semiconductor technology contribute significantly to the growth of the COF market. As chip manufacturers develop smaller and more powerful chips, the compatibility and efficiency of COF technology become increasingly appealing. This aligns with the ongoing trend of miniaturization in the electronics industry, where smaller and thinner devices are preferred. The adaptability of COF to accommodate these smaller and advanced chips positions it as a key player in the market.

Globalization and the rise of emerging economies also play a pivotal role in the COF market dynamics. With the increasing penetration of smartphones, wearables, and other electronic devices in developing regions, the demand for COF solutions rises. Manufacturers are keen on adopting COF technology to produce cost-effective and innovative electronic components. This surge in demand from emerging markets contributes significantly to the overall expansion of the COF market.

The automotive industry is another influential factor shaping the COF market. As automotive manufacturers incorporate more electronic components into vehicles, the need for flexible and reliable solutions like COF becomes evident. COF technology offers the flexibility and durability required for the challenging environments within automotive applications. The growing trend of electric vehicles and smart automotive systems further fuels the demand for COF in this sector.

Moreover, the increasing focus on Internet of Things (IoT) devices contributes substantially to the growth of the COF market. The interconnectivity of devices in IoT applications demands flexible and space-efficient solutions, making COF an ideal choice. From smart home devices to industrial IoT applications, COF technology provides the necessary integration capabilities without compromising on performance.

Supply chain dynamics also influence the COF market, particularly in terms of raw materials and manufacturing processes. The availability and cost of materials used in COF production, such as flexible substrates and conductive materials, impact the overall pricing and competitiveness of COF solutions in the market. Additionally, advancements in manufacturing techniques and processes contribute to improved efficiency and reduced production costs, further driving the market forward.

Leave a Comment