Emergence of Smart Cities

The emergence of smart cities in China is a pivotal driver of the wireless network infrastructure ecosystem market. As urban areas evolve into smart cities, there is an increasing need for advanced telecommunications infrastructure to support various applications, such as traffic management, public safety, and energy efficiency. The Chinese government has launched several smart city initiatives, which aim to integrate technology into urban planning and management. This has led to substantial investments in wireless infrastructure, as cities require robust networks to facilitate real-time data exchange and communication. The growth of smart cities is likely to create new opportunities for telecommunications providers, further stimulating the market.

Increased Focus on Cybersecurity

Increased focus on cybersecurity is becoming a significant driver of the China wireless network infrastructure ecosystem market. As the reliance on wireless networks grows, so does the need for robust security measures to protect sensitive data and maintain user trust. The Chinese government has implemented stringent cybersecurity regulations, which require telecommunications companies to enhance their security protocols. This regulatory environment is prompting investments in advanced security technologies and infrastructure, thereby driving growth in the wireless network sector. Moreover, as businesses and consumers become more aware of cybersecurity threats, the demand for secure wireless solutions is likely to increase, further influencing the market dynamics.

Rising Demand for High-Speed Internet

The demand for high-speed internet services is a critical driver of the China wireless network infrastructure ecosystem market. As urbanization continues to accelerate, more consumers and businesses are seeking reliable and fast internet connectivity. According to recent statistics, the number of internet users in China has surpassed 1 billion, creating a substantial market for wireless infrastructure development. This surge in demand is further fueled by the increasing adoption of digital services, such as e-commerce and online entertainment, which require robust network capabilities. Consequently, telecommunications companies are investing heavily in expanding their wireless infrastructure to meet this growing demand, thereby propelling the market forward.

Government Support and Policy Initiatives

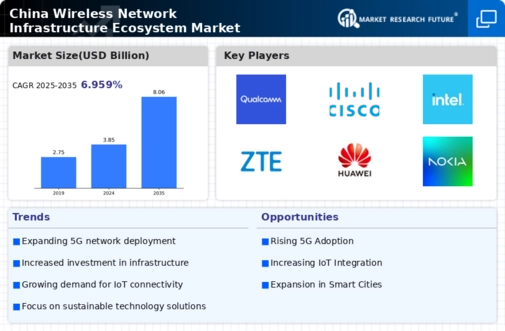

The China wireless network infrastructure ecosystem market benefits significantly from robust government support and policy initiatives. The Chinese government has prioritized the development of advanced telecommunications infrastructure as part of its national strategy. This includes substantial investments in 5G technology, with the aim of achieving nationwide coverage by 2025. The government has also introduced favorable policies to encourage private sector participation, which has led to increased competition and innovation within the market. Furthermore, initiatives such as the 'Made in China 2025' plan emphasize the importance of high-tech industries, including telecommunications, thereby fostering an environment conducive to growth in the wireless network infrastructure sector.

Integration of Internet of Things (IoT) Technologies

The integration of Internet of Things (IoT) technologies is transforming the China wireless network infrastructure ecosystem market. As IoT applications proliferate across various sectors, including manufacturing, healthcare, and smart cities, the need for a reliable and extensive wireless network becomes paramount. The Chinese government has recognized the potential of IoT and is actively promoting its development through various initiatives. For instance, the 'New Infrastructure' initiative aims to enhance the connectivity required for IoT devices, which is expected to drive significant investments in wireless network infrastructure. This trend indicates a shift towards a more interconnected society, where seamless communication between devices is essential.