Growing Awareness of Preventive Healthcare

There is a notable shift towards preventive healthcare in China, which is driving the ultrasound gastroscopes market. As the population becomes more health-conscious, there is an increasing emphasis on early detection and prevention of diseases. This trend is reflected in the rising demand for diagnostic procedures, including those utilizing ultrasound gastroscopes. The ultrasound gastroscopes market is likely to benefit from this growing awareness, as these devices facilitate non-invasive examinations that can identify potential health issues before they escalate. Furthermore, educational campaigns by health authorities are promoting the importance of regular check-ups, which may lead to a higher uptake of ultrasound gastroscopy procedures. This proactive approach to health management is expected to sustain market growth in the coming years.

Rising Prevalence of Gastrointestinal Disorders

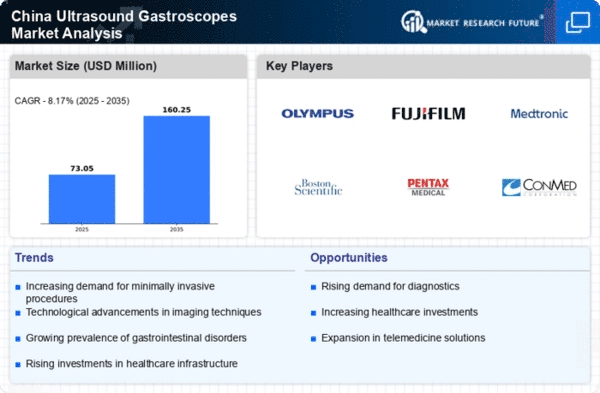

The increasing incidence of gastrointestinal disorders in China is a primary driver for the ultrasound gastroscopes market. Conditions such as gastritis, ulcers, and cancers are becoming more prevalent, leading to a heightened demand for effective diagnostic tools. According to recent health statistics, gastrointestinal diseases account for a significant portion of hospital admissions, prompting healthcare providers to seek advanced imaging technologies. The ultrasound gastroscopes market is poised to benefit from this trend, as these devices offer non-invasive and accurate diagnostic capabilities. Furthermore, the Chinese government has been investing in healthcare infrastructure, which is likely to enhance access to these advanced technologies, thereby driving market growth. As the population ages, the demand for early detection and treatment of gastrointestinal issues is expected to rise, further propelling the ultrasound gastroscopes market forward.

Technological Integration in Healthcare Systems

The integration of advanced technologies into healthcare systems in China is a significant driver for the ultrasound gastroscopes market. The adoption of digital health solutions, such as telemedicine and electronic health records, is transforming how healthcare is delivered. This technological evolution enhances the efficiency and effectiveness of diagnostic procedures, including those involving ultrasound gastroscopes. The ultrasound gastroscopes market is likely to see increased demand as healthcare providers seek to streamline operations and improve patient care. Moreover, the incorporation of artificial intelligence and machine learning in diagnostic imaging is expected to enhance the accuracy and speed of ultrasound gastroscopy procedures. As healthcare systems continue to evolve, the market for ultrasound gastroscopes is anticipated to expand in response to these technological advancements.

Government Initiatives and Healthcare Investments

Government initiatives aimed at improving healthcare access and quality in China are significantly influencing the ultrasound gastroscopes market. The Chinese government has launched various programs to enhance medical technology adoption, particularly in rural and underserved areas. Investments in healthcare infrastructure have increased, with a focus on equipping hospitals with advanced diagnostic tools. The ultrasound gastroscopes market stands to gain from these initiatives, as they align with the government's goal of providing high-quality healthcare services. Additionally, funding for research and development in medical technologies is on the rise, which may lead to innovations in ultrasound gastroscopes. This supportive environment is likely to foster growth in the market, as healthcare providers are encouraged to adopt these advanced diagnostic solutions to improve patient outcomes.

Rising Investment in Medical Research and Development

Investment in medical research and development in China is a crucial factor driving the ultrasound gastroscopes market. The government and private sector are increasingly funding research initiatives aimed at developing innovative medical technologies. This focus on R&D is likely to lead to advancements in ultrasound gastroscopes, enhancing their capabilities and applications. The ultrasound gastroscopes market may experience growth as new features, such as improved imaging quality and enhanced user interfaces, are introduced. Additionally, collaborations between research institutions and medical device manufacturers are fostering innovation, which could result in the launch of next-generation ultrasound gastroscopes. As the demand for cutting-edge medical technologies continues to rise, the market is expected to benefit from these ongoing investments in research and development.