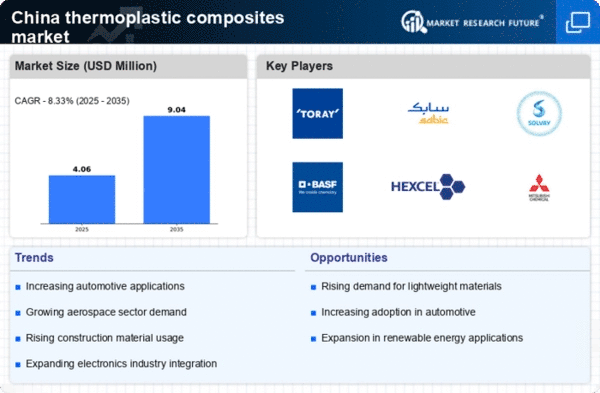

The thermoplastic composites market in China is characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as automotive, aerospace, and consumer goods. Key players are actively pursuing strategies that emphasize innovation, sustainability, and regional expansion. For instance, Toray Industries (Japan) has positioned itself as a leader in advanced materials, focusing on the development of high-performance thermoplastic composites that cater to the automotive industry's shift towards lightweight materials. Similarly, BASF (Germany) is enhancing its operational focus on sustainable solutions, leveraging its extensive research capabilities to create eco-friendly composite materials that meet stringent regulatory standards.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with several key players exerting considerable influence. This fragmentation allows for a diverse range of products and innovations, yet the collective strength of major companies like SABIC (Saudi Arabia) and Hexcel Corporation (US) shapes competitive dynamics significantly. Their strategies often involve strategic partnerships and collaborations aimed at enhancing product offerings and market reach.

In October SABIC (Saudi Arabia) announced a partnership with a leading automotive manufacturer to develop a new line of thermoplastic composite materials specifically designed for electric vehicles. This collaboration is strategically important as it aligns with the growing trend towards electrification in the automotive sector, potentially positioning SABIC as a key supplier in a rapidly evolving market.

In September Hexcel Corporation (US) unveiled a new production facility in China dedicated to the manufacturing of advanced thermoplastic composites. This facility is expected to enhance Hexcel's capacity to meet local demand while also reducing production costs. The establishment of this facility underscores the company's commitment to regional expansion and its strategic focus on increasing operational efficiency.

In August Solvay (Belgium) launched a new range of thermoplastic composite materials aimed at the aerospace sector, emphasizing lightweight and high-strength properties. This product launch is indicative of Solvay's strategy to capitalize on the growing demand for advanced materials in aerospace applications, potentially enhancing its competitive position in this niche market.

As of November current trends in the thermoplastic composites market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance innovation and market responsiveness. The competitive landscape is likely to evolve, shifting from traditional price-based competition towards a focus on technological advancements, supply chain reliability, and sustainable practices. This transition suggests that companies that prioritize innovation and strategic partnerships will be better positioned to thrive in the future.