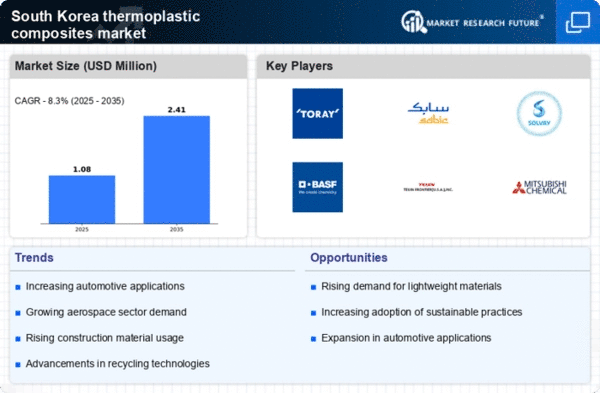

The thermoplastic composites market in South Korea is characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as automotive, aerospace, and consumer goods. Key players are actively pursuing strategies that emphasize innovation, sustainability, and regional expansion. Companies like Toray Industries (Japan) and SABIC (Saudi Arabia) are at the forefront, focusing on advanced material development and strategic partnerships to enhance their market presence. This collective emphasis on innovation and collaboration among major players shapes a competitive environment that is both robust and evolving.In terms of business tactics, localizing manufacturing and optimizing supply chains are critical strategies employed by these companies. The market structure appears moderately fragmented, with several key players exerting influence over specific segments. The collective actions of these companies not only enhance their operational efficiencies but also contribute to a more resilient supply chain, which is increasingly vital in today’s market.

In October Toray Industries (Japan) announced a significant investment in a new production facility in South Korea aimed at increasing its output of high-performance thermoplastic composites. This strategic move is expected to bolster the company’s capacity to meet the growing demand in the automotive sector, particularly for lightweight materials that enhance fuel efficiency. The establishment of this facility underscores Toray's commitment to regional expansion and its focus on innovation in composite materials.

In September SABIC (Saudi Arabia) launched a new line of sustainable thermoplastic composites designed for the automotive industry. This initiative aligns with the global trend towards sustainability and positions SABIC as a leader in eco-friendly material solutions. The introduction of these products not only enhances the company’s portfolio but also reflects a broader industry shift towards environmentally responsible manufacturing practices.

In August BASF (Germany) entered into a strategic partnership with a leading South Korean automotive manufacturer to develop advanced thermoplastic composite solutions. This collaboration aims to leverage BASF's expertise in material science and the automotive manufacturer’s Market Research Future to create innovative products tailored to specific customer needs. Such partnerships are indicative of a trend where companies seek to combine strengths to drive innovation and meet evolving market demands.

As of November current competitive trends in the thermoplastic composites market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing their competitive edge. Looking ahead, it is likely that competitive differentiation will evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This shift suggests that companies that prioritize these areas will be better positioned to thrive in an increasingly complex market.