Expansion of IoT Ecosystem

The rapid expansion of the Internet of Things (IoT) ecosystem in China is creating new opportunities for the system insight market. As more devices become interconnected, the volume of data generated is increasing exponentially. This surge in data presents both challenges and opportunities for businesses seeking to derive insights from their operations. The IoT market in China is projected to grow significantly, with estimates suggesting it could reach $300 billion by 2025. This growth is likely to drive demand for system insight solutions that can effectively analyze and interpret data from diverse IoT devices. Companies are looking for ways to harness this data to improve decision-making, enhance customer experiences, and drive innovation, thereby fueling the growth of the system insight market.

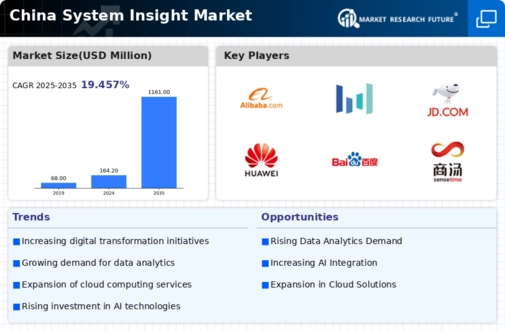

Rising Demand for Data Analytics

The increasing reliance on data-driven decision-making in various sectors is propelling the system insight market in China. Organizations are recognizing the value of data analytics to enhance operational efficiency and customer engagement. According to recent statistics, the data analytics market in China is projected to grow at a CAGR of approximately 25% from 2025 to 2030. This surge in demand for advanced analytics tools and solutions is likely to drive investments in the system insight market. Companies are seeking to leverage insights derived from data to gain competitive advantages, thereby fostering innovation and improving service delivery. As businesses strive to adapt to rapidly changing market conditions, the need for robust system insight solutions becomes increasingly critical.

Government Initiatives and Support

The Chinese government is actively promoting the adoption of advanced technologies, including system insight solutions, as part of its broader strategy to enhance digital transformation across industries. Initiatives such as the 'Made in China 2025' plan emphasize the importance of integrating smart technologies into manufacturing and service sectors. This governmental support is likely to create a conducive environment for the growth of the system insight market. Financial incentives, grants, and subsidies are being offered to encourage businesses to invest innovative technologies. As a result, The system insight market is expected to benefit from increased funding and resources. This will facilitate the development of cutting-edge solutions tailored to meet the specific needs of various industries.

Growing Importance of Cybersecurity

As organizations in China increasingly adopt digital solutions, the importance of cybersecurity in the system insight market cannot be overstated. The rise in cyber threats has prompted businesses to prioritize the protection of sensitive data and systems. Consequently, there is a growing demand for system insight solutions that incorporate robust security features. According to industry reports, the cybersecurity market in China is anticipated to reach approximately $40 billion by 2025, indicating a strong correlation with the system insight market. Companies are seeking integrated solutions that not only provide insights but also ensure data integrity and security. This trend is likely to drive innovation in the system insight market, as providers develop solutions that address both analytical needs and cybersecurity concerns.

Increased Focus on Operational Efficiency

Organizations in China are increasingly focusing on enhancing operational efficiency to remain competitive in a dynamic market landscape. The system insight market is poised to benefit from this trend, as businesses seek solutions that provide actionable insights into their operations. By leveraging system insight tools, companies can identify inefficiencies, optimize resource allocation, and improve overall productivity. Recent studies indicate that organizations that implement data-driven strategies can achieve operational cost reductions of up to 20%. This emphasis on efficiency is likely to drive demand for system insight solutions that enable real-time monitoring and analysis of business processes, ultimately leading to improved performance and profitability.