Rising Demand for Real-Time Analytics

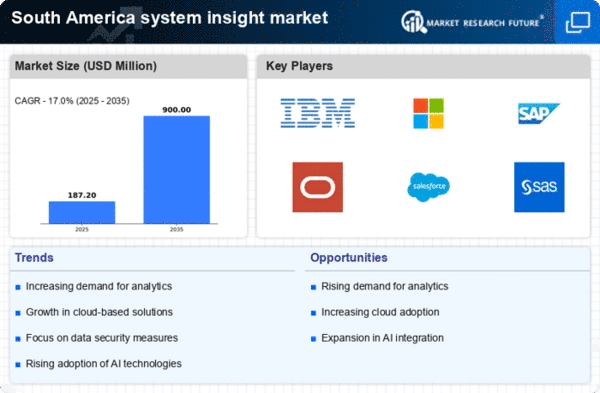

The system insight market in South America experiences a notable surge in demand for real-time analytics. Businesses increasingly recognize the value of immediate data insights to enhance decision-making processes. This trend is particularly evident in sectors such as retail and finance, where timely information can lead to competitive advantages. According to recent studies, approximately 65% of organizations in South America are prioritizing real-time data capabilities. This shift is likely to drive investments in advanced analytics tools and platforms, fostering growth within the system insight market. As companies strive to optimize operations and improve customer experiences, the need for real-time insights becomes paramount, indicating a robust trajectory for market expansion.

Regulatory Changes Promoting Data Utilization

Regulatory changes in South America are fostering an environment conducive to data utilization, which in turn influences the system insight market. Governments are implementing policies that encourage businesses to harness data for economic growth while ensuring compliance with privacy standards. For instance, recent legislation aims to enhance data accessibility for companies, potentially increasing the demand for system insight solutions. As organizations navigate these regulatory landscapes, they are likely to invest in technologies that facilitate compliance and data analysis. This regulatory shift may create new opportunities for growth within the system insight market, as businesses adapt to evolving legal frameworks.

Increased Investment in Digital Transformation

Digital transformation initiatives are gaining momentum in South America, leading to heightened investments in technology solutions, including those within the system insight market. Organizations are increasingly adopting digital tools to streamline operations and enhance customer engagement. A recent report indicates that approximately 60% of companies in the region plan to allocate more resources to digital transformation projects over the next few years. This trend is likely to create a favorable environment for system insight solutions, as businesses seek to leverage data analytics to support their transformation efforts. The focus on digitalization may drive innovation and competition within the market.

Growing Emphasis on Data-Driven Decision Making

In South America, there is an increasing emphasis on data-driven decision making across various industries. Organizations are recognizing that leveraging data insights can lead to improved operational efficiency and strategic planning. This trend is reflected in a survey indicating that over 70% of executives in the region believe data analytics is crucial for their business success. Consequently, the system insight market is witnessing a rise in demand for tools that facilitate data analysis and visualization. As companies seek to harness the power of data, investments in system insight solutions are expected to grow, potentially leading to a more competitive business landscape in South America.

Expansion of Internet of Things (IoT) Applications

The proliferation of Internet of Things (IoT) applications in South America significantly impacts the system insight market. As more devices become interconnected, the volume of data generated increases exponentially. This surge in data necessitates advanced analytics solutions to derive actionable insights. Reports suggest that the IoT market in South America is projected to reach $30 billion by 2026, creating substantial opportunities for system insight providers. Companies are likely to invest in technologies that can process and analyze IoT data effectively, thereby enhancing their operational capabilities and driving growth in the system insight market.