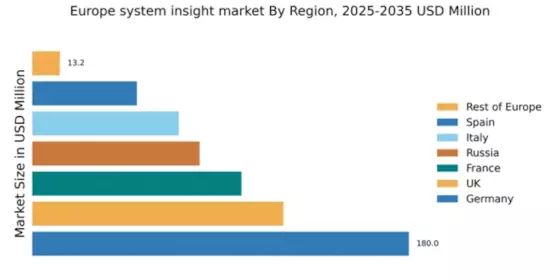

Germany : Robust Growth and Innovation Hub

Germany holds a commanding market share of 36% in the European system insight market, valued at $180.0 million. Key growth drivers include a strong emphasis on digital transformation, supported by government initiatives like the Digital Strategy 2025. Demand for data analytics and AI solutions is surging, driven by industries such as automotive and manufacturing. Regulatory frameworks are increasingly supportive, fostering innovation and investment in infrastructure development. Key markets include Berlin, Munich, and Frankfurt, where major players like SAP and IBM have a significant presence. The competitive landscape is characterized by a mix of established firms and startups, creating a dynamic business environment. Local industries are leveraging system insights for operational efficiency, particularly in finance and logistics, enhancing their global competitiveness.

UK : Innovation and Adaptation Drive Growth

The UK system insight market is valued at $120.0 million, accounting for 24% of the European market. Growth is driven by the rapid adoption of cloud technologies and a strong focus on data privacy regulations like GDPR. The demand for real-time analytics is increasing, particularly in sectors such as finance and retail, where consumer insights are crucial. Government initiatives are promoting tech innovation, enhancing the overall market landscape. Key cities include London, Manchester, and Edinburgh, where major players like Microsoft and Oracle are actively competing. The market is characterized by a blend of traditional firms and agile tech startups, fostering a competitive environment. Local businesses are increasingly utilizing system insights to enhance customer engagement and streamline operations, particularly in e-commerce and financial services.

France : Strong Demand in Key Sectors

France's system insight market is valued at $100.0 million, representing 20% of the European market. Growth is fueled by increasing investments in AI and machine learning, particularly in sectors like healthcare and retail. The French government is actively supporting digital initiatives, including the France 2030 plan, which aims to boost innovation. Demand for data-driven decision-making is rising, reflecting a shift towards more analytical business practices. Key markets include Paris, Lyon, and Toulouse, where major players like SAP and Salesforce are well-established. The competitive landscape features both large corporations and innovative startups, creating a vibrant ecosystem. Local industries are leveraging system insights to improve operational efficiency and customer satisfaction, particularly in logistics and supply chain management.

Russia : Regulatory Landscape Influences Growth

Russia's system insight market is valued at $80.0 million, capturing 16% of the European market. Key growth drivers include increasing digitalization across various sectors, particularly in energy and telecommunications. However, regulatory challenges and geopolitical factors can impact market dynamics. The Russian government is promoting digital initiatives, aiming to enhance the country's technological capabilities and infrastructure. Key cities include Moscow and St. Petersburg, where major players like Oracle and IBM are making inroads. The competitive landscape is evolving, with local firms emerging alongside international players. Businesses are increasingly adopting system insights to optimize operations and enhance service delivery, particularly in the energy sector, where data analytics plays a crucial role.

Italy : Focus on Innovation and Technology

Italy's system insight market is valued at $70.0 million, representing 14% of the European market. Growth is driven by a focus on innovation, particularly in manufacturing and fashion industries. The Italian government is supporting digital transformation through initiatives like the National Industry 4.0 Plan, which encourages investment in technology. Demand for data analytics is rising, reflecting a shift towards more data-driven decision-making in local businesses. Key markets include Milan, Rome, and Turin, where major players like SAP and Microsoft are actively competing. The competitive landscape features a mix of established firms and emerging startups, fostering innovation. Local industries are leveraging system insights to enhance product development and customer engagement, particularly in fashion and automotive sectors.

Spain : Digital Transformation Accelerates Demand

Spain's system insight market is valued at $50.0 million, accounting for 10% of the European market. Growth is driven by increasing digitalization across various sectors, particularly in tourism and retail. The Spanish government is promoting digital initiatives, including the Digital Spain 2025 strategy, which aims to enhance technological capabilities. Demand for data analytics is rising, reflecting a shift towards more analytical business practices in local industries. Key cities include Madrid and Barcelona, where major players like Salesforce and IBM are establishing a strong presence. The competitive landscape is characterized by a mix of traditional firms and innovative startups, creating a dynamic business environment. Local businesses are increasingly utilizing system insights to improve customer experiences and operational efficiency, particularly in the tourism sector.

Rest of Europe : Opportunities Across Multiple Sectors

The Rest of Europe system insight market is valued at $13.2 million, representing a smaller yet significant portion of the European market. Growth is driven by varying levels of digital adoption across countries, with some regions rapidly embracing technology while others lag behind. Government initiatives are promoting digital transformation, but the pace varies significantly. Demand for data analytics is emerging in sectors like agriculture and manufacturing, reflecting local needs and conditions. Key markets include countries like Belgium, Netherlands, and the Nordics, where local players are beginning to establish themselves. The competitive landscape is diverse, with a mix of established firms and new entrants. Local industries are leveraging system insights to enhance productivity and innovation, particularly in agriculture and renewable energy sectors.