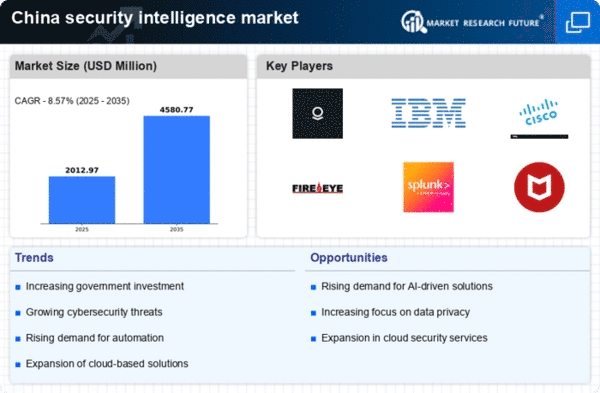

Increased Cyber Threats

The security intelligence market in China is experiencing heightened demand due to the surge in cyber threats. With the rapid digitalization of businesses, the number of cyberattacks has escalated, prompting organizations to invest in advanced security solutions. Reports indicate that cybercrime costs in China could reach $1 trillion by 2025, underscoring the urgency for robust security measures. This environment fosters a growing reliance on security intelligence tools that can proactively identify and mitigate risks. As companies face sophisticated threats, the need for real-time threat intelligence becomes paramount, driving growth in the security intelligence market. Organizations are increasingly adopting integrated solutions that combine threat detection, incident response, and risk management, thereby enhancing their overall security posture.

Emergence of Advanced Analytics

The integration of advanced analytics into security intelligence solutions is transforming the market in China. Organizations are increasingly leveraging data analytics to gain insights into potential threats and vulnerabilities. This trend is driven by the need for proactive security measures that can anticipate and mitigate risks before they escalate. The security intelligence market is witnessing a shift towards solutions that utilize machine learning and big data analytics to enhance threat detection capabilities. As businesses recognize the value of data-driven decision-making, investments in advanced analytics are expected to rise significantly. It is projected that the market for analytics-driven security intelligence solutions will grow by 30% over the next five years, reflecting the increasing reliance on data to inform security strategies.

Growing Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices in China is reshaping the security intelligence market landscape. As more devices become interconnected, the potential attack surface for cyber threats expands, necessitating enhanced security measures. It is estimated that the number of IoT devices in China will surpass 1 billion by 2025, creating a pressing need for security intelligence solutions that can monitor and protect these devices. Organizations are increasingly recognizing the importance of integrating security intelligence into their IoT strategies to safeguard against vulnerabilities. This trend is likely to drive innovation in security intelligence technologies, as companies seek to develop solutions that can effectively manage and secure vast networks of IoT devices.

Rising Awareness of Data Privacy

In recent years, there has been a marked increase in awareness regarding data privacy among consumers and businesses in China. This shift is influencing the security intelligence market as organizations strive to comply with stringent data protection regulations. The implementation of laws such as the Personal Information Protection Law (PIPL) necessitates that companies adopt robust security measures to protect sensitive information. As a result, the demand for security intelligence solutions that ensure compliance and safeguard data integrity is on the rise. Market analysts suggest that the security intelligence market could grow by 20% annually as organizations prioritize data privacy and invest in technologies that enhance their security frameworks.

Government Initiatives and Policies

The Chinese government is actively promoting initiatives aimed at strengthening national cybersecurity, which significantly impacts the security intelligence market. Policies such as the Cybersecurity Law and the National Cybersecurity Strategy emphasize the importance of protecting critical infrastructure and sensitive data. These regulations compel businesses to adopt comprehensive security frameworks, thereby increasing the demand for security intelligence solutions. The government has allocated substantial funding to enhance cybersecurity capabilities, with investments projected to exceed $10 billion by 2025. This supportive regulatory environment not only encourages innovation within the security intelligence market but also fosters collaboration between public and private sectors, leading to the development of advanced security technologies.