Growing Cyber Threat Landscape

The security analytics market in China is experiencing a surge due to the escalating cyber threat landscape. With increasing incidents of data breaches and cyberattacks, organizations are compelled to adopt advanced security analytics solutions. In 2025, it is estimated that cybercrime could cost the global economy over $10 trillion annually, prompting Chinese enterprises to invest heavily in security measures. The need for real-time threat detection and response capabilities is driving demand for sophisticated analytics tools. As businesses recognize the potential financial and reputational damage from cyber threats, the security analytics market is expected to expand significantly, with a projected growth rate of approximately 20% annually in the coming years..

Digital Transformation Initiatives

China's rapid digital transformation is significantly impacting the security analytics market. As organizations migrate to digital platforms, the complexity of their IT environments increases, leading to heightened security risks. The demand for security analytics solutions is likely to rise as businesses seek to protect their digital assets. In 2025, it is anticipated that the digital economy in China will account for over 50% of the GDP, further emphasizing the need for effective security measures. Consequently, the security analytics market will witness a growth rate of approximately 18% as companies invest in analytics tools to safeguard their digital infrastructures..

Emergence of Advanced Technologies

The emergence of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), is reshaping the security analytics market in China. These technologies enable organizations to analyze vast amounts of data and identify potential threats more efficiently. As businesses increasingly adopt AI-driven security solutions, the demand for security analytics tools is expected to rise. In 2025, the market for AI in cybersecurity is projected to reach $30 billion, indicating a robust growth trajectory. This trend suggests that organizations are recognizing the value of integrating advanced technologies into their security frameworks, potentially leading to a market growth rate of around 19% in the coming years.

Regulatory Pressures and Compliance

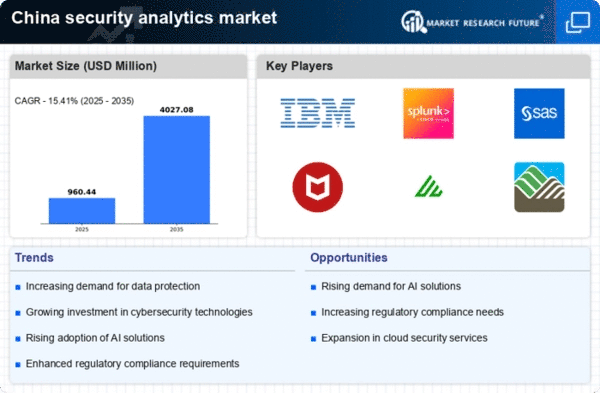

In China, regulatory pressures are intensifying, compelling organizations to enhance their security measures. The implementation of stringent data protection laws, such as the Personal Information Protection Law (PIPL), necessitates robust compliance strategies. Companies are increasingly turning to the security analytics market to ensure adherence to these regulations. The market is projected to grow as organizations seek solutions that not only protect sensitive data but also provide comprehensive reporting capabilities to demonstrate compliance. This trend is expected to drive a market growth rate of around 15% in the next few years, as businesses prioritize regulatory compliance alongside their security strategies.

Increased Investment in Cybersecurity

The Chinese government is prioritizing cybersecurity, leading to increased investments in the security analytics market. Initiatives aimed at enhancing national cybersecurity capabilities are driving public and private sector collaboration. In 2025, it is projected that cybersecurity spending in China will exceed $40 billion, with a significant portion allocated to security analytics solutions. This influx of capital is likely to foster innovation and development within the market, as companies seek to leverage advanced analytics for threat detection and incident response. The anticipated growth rate for the security analytics market could reach 22% as organizations respond to the government's call for enhanced cybersecurity measures.