Rising Geriatric Population

The increasing geriatric population in China is a pivotal driver for the China ophthalmic drugs market. As the population ages, the prevalence of age-related eye disorders, such as cataracts and macular degeneration, is expected to rise significantly. According to the National Bureau of Statistics of China, the number of individuals aged 60 and above is projected to reach 400 million by 2040. This demographic shift necessitates a greater demand for ophthalmic drugs, as older adults are more susceptible to various eye conditions. Consequently, pharmaceutical companies are likely to focus on developing innovative treatments tailored to this demographic, thereby expanding their market presence. The growing awareness of eye health among the elderly is also expected to drive the demand for regular eye check-ups and subsequent treatments, further propelling the growth of the china ophthalmic drugs market.

Rising Awareness of Eye Health

Rising awareness of eye health among the Chinese population is emerging as a significant driver for the China ophthalmic drugs market. Public health campaigns and educational initiatives have been instrumental in informing citizens about the importance of regular eye examinations and early detection of eye diseases. The Chinese government has launched various programs aimed at reducing the incidence of preventable blindness, which has contributed to a cultural shift towards prioritizing eye health. As awareness increases, more individuals are likely to seek medical attention for eye-related issues, leading to a higher demand for ophthalmic drugs. In 2024, it was reported that over 60% of urban residents had undergone an eye examination in the past year, indicating a growing trend towards proactive eye care. This heightened awareness is expected to bolster the growth of the china ophthalmic drugs market.

Increasing Healthcare Expenditure

The rising healthcare expenditure in China is a crucial driver for the China ophthalmic drugs market. As the government continues to enhance its healthcare infrastructure, spending on medical services and pharmaceuticals is expected to increase. In 2025, China's healthcare expenditure was estimated to reach 10 trillion yuan, reflecting a growing commitment to improving public health. This increase in spending is likely to result in greater accessibility to ophthalmic drugs, as more patients seek treatment for eye disorders. Furthermore, the implementation of the Healthy China 2030 initiative aims to promote eye health awareness and preventive care, which could lead to an uptick in the diagnosis and treatment of eye conditions. Consequently, the combination of increased healthcare funding and public health initiatives is anticipated to drive the growth of the china ophthalmic drugs market.

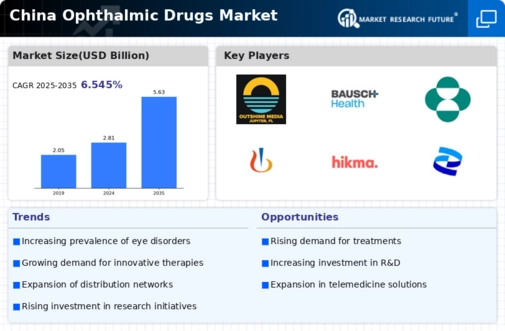

Expansion of Distribution Channels

The expansion of distribution channels within the China ophthalmic drugs market is facilitating greater access to ophthalmic medications. The rise of e-commerce platforms and online pharmacies has transformed the way patients obtain their prescriptions, making it more convenient for consumers to access necessary treatments. In 2025, online sales of pharmaceuticals in China accounted for approximately 15% of the total market share, reflecting a shift in consumer purchasing behavior. Additionally, partnerships between pharmaceutical companies and healthcare providers are enhancing the availability of ophthalmic drugs in rural and underserved areas. This increased accessibility is likely to drive sales and improve patient adherence to prescribed treatments. As distribution channels continue to evolve, the china ophthalmic drugs market is expected to experience sustained growth, catering to the diverse needs of the population.

Technological Advancements in Drug Development

Technological advancements in drug development are significantly influencing the China ophthalmic drugs market. Innovations such as nanotechnology and gene therapy are paving the way for more effective and targeted treatments for various eye conditions. For instance, the introduction of sustained-release drug delivery systems has shown promise in enhancing the efficacy of ophthalmic medications. The Chinese government has been actively promoting research and development in the pharmaceutical sector, with initiatives aimed at fostering innovation. In 2023, the total investment in pharmaceutical R&D reached approximately 200 billion yuan, indicating a robust commitment to advancing healthcare solutions. These technological breakthroughs not only improve patient outcomes but also attract investments, thereby stimulating growth within the china ophthalmic drugs market.