Increasing Aging Population

The demographic shift towards an aging population in China is a pivotal driver for the China Ophthalmic Drugs Devices Market. As the population ages, the prevalence of age-related eye disorders, such as cataracts and macular degeneration, is expected to rise significantly. According to recent statistics, approximately 20% of the Chinese population will be over 60 years old by 2035, leading to a surge in demand for ophthalmic drugs and devices. This demographic trend necessitates enhanced healthcare services and innovative treatment options, thereby propelling market growth. Furthermore, the government is likely to invest in healthcare infrastructure to accommodate this growing need, which could further stimulate the China Ophthalmic Drugs Devices Market.

Rising Awareness of Eye Health

There is a notable increase in awareness regarding eye health among the Chinese population, which serves as a crucial driver for the China Ophthalmic Drugs Devices Market. Public health campaigns and educational initiatives have been implemented to inform citizens about the importance of regular eye examinations and early detection of eye diseases. This heightened awareness is likely to lead to increased consultations with ophthalmologists and, consequently, a higher demand for ophthalmic drugs and devices. Market data suggests that the sales of prescription eyewear and therapeutic eye drops have seen a steady rise, indicating a shift in consumer behavior towards proactive eye care. As awareness continues to grow, the China Ophthalmic Drugs Devices Market is expected to expand further.

Advancements in Medical Technology

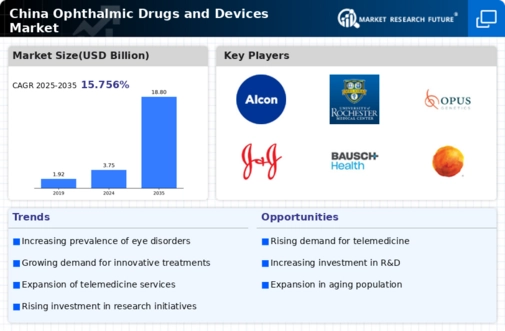

Technological advancements in medical devices and pharmaceuticals are significantly influencing the China Ophthalmic Drugs Devices Market. Innovations such as minimally invasive surgical techniques, advanced diagnostic tools, and novel drug formulations are enhancing treatment outcomes for various eye conditions. For instance, the introduction of smart contact lenses and telemedicine solutions is revolutionizing patient care and monitoring. The market for ophthalmic devices is projected to grow at a compound annual growth rate (CAGR) of over 10% in the coming years, driven by these technological innovations. As manufacturers continue to invest in research and development, the China Ophthalmic Drugs Devices Market is poised for substantial growth, catering to the evolving needs of patients and healthcare providers.

Government Support and Policy Framework

The Chinese government has been actively promoting the development of the healthcare sector, which includes the China Ophthalmic Drugs Devices Market. Policies aimed at improving healthcare access and affordability are likely to enhance the market landscape. Initiatives such as the Healthy China 2030 plan emphasize the importance of eye health and aim to reduce the burden of eye diseases. Additionally, the government is expected to provide financial incentives for research and development in ophthalmic technologies, fostering innovation. This supportive policy environment is anticipated to attract both domestic and foreign investments, further propelling the growth of the China Ophthalmic Drugs Devices Market.

Growing Urbanization and Lifestyle Changes

Rapid urbanization in China is contributing to lifestyle changes that may adversely affect eye health, thus driving the China Ophthalmic Drugs Devices Market. Increased screen time due to digital devices, coupled with environmental factors such as pollution, is leading to a rise in conditions like myopia and dry eye syndrome. Recent studies indicate that urban areas are witnessing a higher prevalence of these disorders, prompting a greater need for ophthalmic interventions. As urban populations continue to grow, the demand for effective ophthalmic drugs and devices is likely to escalate. This trend presents a unique opportunity for stakeholders in the China Ophthalmic Drugs Devices Market to develop targeted solutions that address the specific needs of urban dwellers.