Regulatory Support for Market Growth

Regulatory support is a significant driver for the mobile virtual-network-operator market in China. The government has implemented policies aimed at promoting competition and facilitating the entry of MVNOs into the telecommunications sector. Recent regulatory changes have simplified the licensing process for new operators, encouraging investment and innovation. As a result, the number of MVNOs has expanded, contributing to a more competitive market landscape. Furthermore, the government's commitment to enhancing digital infrastructure aligns with the growth objectives of MVNOs, as improved network capabilities enable better service delivery. This supportive regulatory environment is expected to bolster the mobile virtual-network-operator market, fostering an ecosystem conducive to growth and development.

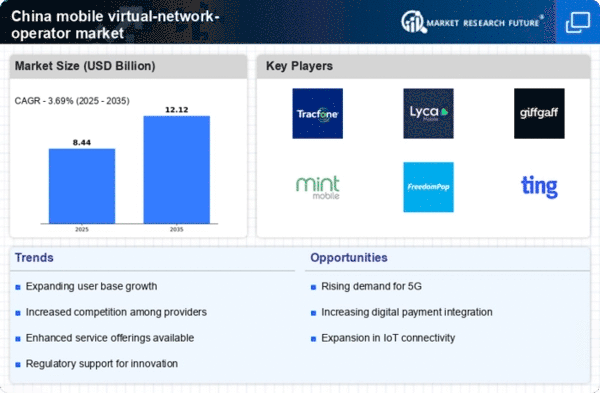

Rising Demand for Affordable Services

The mobile virtual-network-operator market in China experiences a notable increase in demand for affordable mobile services. As consumers seek cost-effective alternatives to traditional mobile network operators, MVNOs are positioned to cater to this need. The market has seen a surge in subscribers, with estimates indicating that MVNOs could capture up to 20% of the total mobile subscriber base by 2025. This trend is driven by the growing awareness of competitive pricing and flexible plans offered by MVNOs, which appeal to budget-conscious consumers. Additionally, the increasing penetration of smartphones and mobile internet access further fuels this demand, as users look for economical options without compromising on service quality. Consequently, the mobile virtual-network-operator market is likely to expand significantly, driven by this rising consumer preference for affordability.

Consumer Shift Towards Digital Services

A notable consumer shift towards digital services is influencing the mobile virtual-network-operator market in China. As users increasingly rely on mobile applications and online platforms for communication, entertainment, and commerce, MVNOs are adapting their offerings to meet these evolving demands. The rise of digital payment solutions and streaming services has prompted MVNOs to bundle these features into their plans, enhancing their appeal. Data indicates that mobile data traffic in China is projected to grow by 40% annually, driven by the increasing consumption of digital content. This trend presents a significant opportunity for MVNOs to capture a larger market share by providing tailored packages that cater to the digital lifestyle of consumers. Thus, the mobile virtual-network-operator market is likely to benefit from this ongoing consumer transition towards digital services.

Increased Competition Among Service Providers

The mobile virtual-network-operator market in China is characterized by heightened competition among service providers. As more MVNOs enter the market, they introduce diverse offerings that challenge traditional mobile network operators. This competitive landscape encourages innovation and drives down prices, benefiting consumers. Recent data suggests that the number of MVNOs in China has increased by over 50% in the past two years, indicating a robust market entry. This influx of players not only enhances service variety but also compels existing operators to improve their service quality and pricing strategies. Consequently, the mobile virtual-network-operator market is likely to witness sustained growth as competition fosters a dynamic environment that prioritizes consumer needs and preferences.

Technological Advancements in Service Delivery

Technological advancements play a crucial role in shaping the mobile virtual-network-operator market in China. Innovations such as 5G technology and enhanced data analytics capabilities enable MVNOs to offer superior services and personalized customer experiences. The integration of artificial intelligence and machine learning into service delivery systems allows MVNOs to optimize their operations and improve customer engagement. As of 2025, it is projected that the adoption of 5G will lead to a 30% increase in data consumption among mobile users, further benefiting MVNOs that can leverage this technology. Moreover, the ability to provide tailored plans based on user behavior and preferences enhances customer satisfaction and loyalty. Thus, the mobile virtual-network-operator market is likely to thrive as technological advancements continue to evolve and reshape service delivery.