Rising Incidence of Cancer

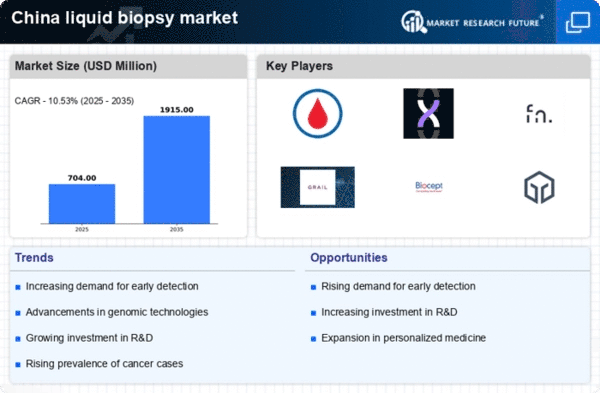

The increasing incidence of cancer in China is a primary driver for the liquid biopsy market. With cancer cases projected to rise significantly, the demand for non-invasive diagnostic methods is likely to grow. Liquid biopsies offer a less invasive alternative to traditional tissue biopsies, allowing for earlier detection and monitoring of cancer progression. According to recent statistics, cancer is expected to account for approximately 23% of all deaths in China by 2030. This alarming trend underscores the necessity for innovative diagnostic solutions, positioning the liquid biopsy market as a critical component in the fight against cancer. As healthcare providers seek efficient and effective diagnostic tools, the liquid biopsy market is poised for substantial growth, potentially reaching a valuation of $2 billion by 2027.

Increased Healthcare Expenditure

China's rising healthcare expenditure is a significant driver for the liquid biopsy market. The government has been investing heavily in healthcare infrastructure and services, aiming to improve access to advanced diagnostic tools. In 2025, healthcare spending is projected to reach approximately $1 trillion, reflecting a commitment to enhancing patient care. This increase in funding is likely to facilitate the adoption of innovative technologies, including liquid biopsies, which are seen as essential for early cancer detection and monitoring. The liquid biopsy market stands to benefit from this trend, as healthcare providers seek to integrate cost-effective and efficient diagnostic solutions into their practices, potentially leading to a market growth rate of 20% over the next five years.

Advancements in Genomic Technologies

Technological advancements in genomic sequencing and analysis are propelling the liquid biopsy market forward in China. Innovations such as next-generation sequencing (NGS) and digital PCR are enhancing the sensitivity and specificity of liquid biopsies. These technologies enable the detection of circulating tumor DNA (ctDNA) and other biomarkers with unprecedented accuracy. As a result, healthcare professionals can make more informed decisions regarding treatment options. The liquid biopsy market is experiencing a surge in research and development investments, with funding increasing by approximately 15% annually. This trend suggests a robust future for liquid biopsies, as they become integral to personalized medicine and targeted therapies, ultimately improving patient outcomes.

Growing Awareness of Early Detection

There is a growing awareness among the Chinese population regarding the importance of early cancer detection, which is driving the liquid biopsy market. Public health campaigns and educational initiatives are emphasizing the benefits of early diagnosis, leading to increased demand for non-invasive testing methods. Liquid biopsies are gaining traction as they provide timely insights into cancer progression without the need for invasive procedures. This shift in public perception is likely to result in a higher adoption rate of liquid biopsies, as patients and healthcare providers alike recognize their potential. The liquid biopsy market is expected to capitalize on this trend, with an anticipated market growth of 18% annually as more individuals seek out these innovative diagnostic options.

Regulatory Support for Innovative Diagnostics

Regulatory support for innovative diagnostic methods is fostering growth in the liquid biopsy market. The Chinese government has been actively promoting the development and approval of advanced diagnostic technologies, streamlining the regulatory process for liquid biopsies. This supportive environment encourages research and development, allowing companies to bring their products to market more efficiently. As a result, the liquid biopsy market is likely to see an influx of new products and technologies, enhancing competition and driving innovation. With regulatory bodies prioritizing patient safety and efficacy, the liquid biopsy market is positioned for robust growth, potentially expanding by 25% over the next few years as new solutions become available.