Evolving Legal Frameworks

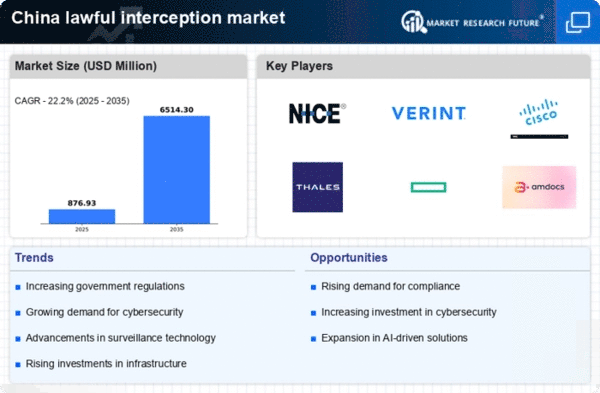

The legal landscape surrounding data privacy and surveillance in China is evolving, which has implications for the lawful interception market. Recent amendments to laws governing data protection and privacy have prompted organizations to reassess their interception strategies. Compliance with these evolving legal frameworks is crucial for businesses operating in China, as non-compliance can result in severe penalties. As of 2025, it is estimated that over 60% of companies will need to upgrade their lawful interception systems to align with new regulations. This shift indicates a growing market for interception technologies that can adapt to changing legal requirements.

Rising Cybersecurity Threats

The increasing prevalence of cyber threats in China has propelled the demand for robust security measures, thereby influencing the lawful interception market. As cybercriminals become more sophisticated, organizations are compelled to adopt advanced interception technologies to safeguard sensitive data. In 2025, the cybersecurity market in China is projected to reach approximately $30 billion, indicating a strong correlation with the growth of the lawful interception market. This trend suggests that as businesses and government entities prioritize cybersecurity, investments in lawful interception capabilities are likely to rise, ensuring compliance with legal frameworks while enhancing overall security protocols.

Increased Focus on Data Privacy

As awareness of data privacy issues rises among consumers and businesses in China, there is a growing demand for lawful interception solutions that balance security and privacy. Organizations are increasingly recognizing the importance of implementing interception technologies that comply with privacy regulations while still providing necessary security measures. In 2025, it is projected that the data privacy market in China will grow by approximately 20%, reflecting a heightened focus on protecting personal information. This trend suggests that the lawful interception market will need to innovate and offer solutions that address both security needs and privacy concerns.

Government Surveillance Initiatives

China's government has implemented various surveillance initiatives aimed at maintaining national security and public safety. These initiatives often necessitate the use of lawful interception technologies to monitor communications effectively. The lawful interception market is expected to benefit from these government policies, as they create a conducive environment for the adoption of interception solutions. In recent years, the government has allocated substantial budgets for surveillance technologies, with estimates suggesting an increase of over 15% in funding for such initiatives in 2025. This trend indicates a sustained demand for lawful interception solutions to support these efforts.

Telecommunications Infrastructure Expansion

The rapid expansion of telecommunications infrastructure in China is a significant driver for the lawful interception market. With the rollout of 5G networks and the increasing number of mobile subscribers, the volume of data traffic is surging. This growth necessitates the implementation of lawful interception technologies to ensure compliance with regulatory requirements. In 2025, it is anticipated that the number of mobile subscribers in China will exceed 1.5 billion, further amplifying the need for effective interception solutions. Consequently, the lawful interception market is likely to experience substantial growth as telecommunications providers seek to enhance their capabilities.