Expansion of Research Institutions

The proliferation of research institutions in China is contributing to the growth of the immunofluorescence assay market. With an increasing number of universities and research centers focusing on life sciences, there is a heightened demand for advanced laboratory techniques, including immunofluorescence assays. These institutions are not only conducting fundamental research but are also collaborating with industry partners to develop innovative diagnostic solutions. This collaborative environment is expected to enhance the capabilities and applications of immunofluorescence assays, thereby expanding their market reach. The investment in research infrastructure is projected to increase by approximately 20% over the next five years, further solidifying the role of research institutions as a key driver for the immunofluorescence assay market.

Rising Demand for Diagnostic Tools

The increasing prevalence of chronic diseases in China is driving the demand for advanced diagnostic tools, including immunofluorescence assays. As healthcare providers seek more accurate and efficient methods for disease detection, the immunofluorescence assay market is likely to experience significant growth. According to recent estimates, the market for diagnostic tools in China is projected to reach approximately $10 billion by 2026, with immunofluorescence assays playing a crucial role in this expansion. The ability of these assays to provide rapid and reliable results is particularly appealing in a healthcare landscape that prioritizes timely interventions. Consequently, the rising demand for diagnostic tools is a key driver for the immunofluorescence assay market, as it aligns with the broader trend of enhancing healthcare outcomes through innovative technologies.

Increased Investment in Biotechnology

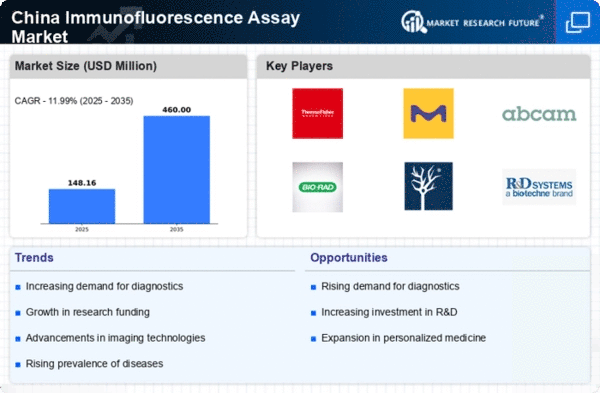

China's commitment to advancing its biotechnology sector is fostering a conducive environment for the growth of the immunofluorescence assay market. The government has allocated substantial funding to support research and development initiatives, which has led to the emergence of numerous biotech firms specializing in diagnostic solutions. This influx of investment is expected to enhance the capabilities of immunofluorescence assays, making them more accessible and effective for various applications. As a result, the immunofluorescence assay market is likely to benefit from this trend, with projections indicating a compound annual growth rate (CAGR) of around 8% over the next five years. The synergy between government support and private sector innovation is a pivotal factor driving the growth of the immunofluorescence assay market in China.

Growing Focus on Personalized Medicine

The shift towards personalized medicine in China is significantly influencing the immunofluorescence assay market. As healthcare providers increasingly recognize the importance of tailoring treatments to individual patient profiles, the demand for precise diagnostic tools has surged. Immunofluorescence assays, known for their ability to detect specific biomarkers, are becoming essential in this context. This trend is further supported by the rising number of clinical trials aimed at developing targeted therapies, which often rely on immunofluorescence assays for patient stratification. The market is expected to grow as healthcare systems adapt to this personalized approach, with estimates suggesting a potential increase in market size by 15% over the next few years. Thus, the growing focus on personalized medicine serves as a significant driver for the immunofluorescence assay market.

Rising Awareness of Autoimmune Diseases

The growing awareness of autoimmune diseases among the Chinese population is driving the demand for effective diagnostic tools, including immunofluorescence assays. As more individuals seek medical attention for symptoms related to autoimmune conditions, healthcare providers are increasingly relying on these assays for accurate diagnosis. The immunofluorescence assay market is likely to benefit from this trend, as these assays are particularly effective in detecting specific autoantibodies associated with various autoimmune disorders. Recent surveys indicate that approximately 5% of the population may be affected by autoimmune diseases, highlighting the need for reliable diagnostic methods. Consequently, the rising awareness of autoimmune diseases is a crucial driver for the immunofluorescence assay market, as it aligns with the broader healthcare objective of improving patient outcomes through timely and accurate diagnosis.

Leave a Comment