Rising Demand for Diagnostic Tools

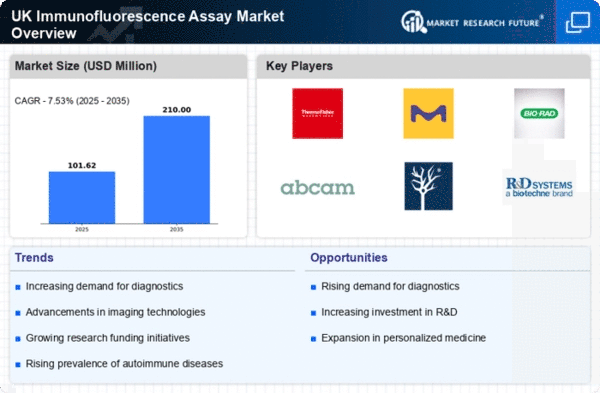

The increasing prevalence of chronic diseases and infections in the UK is driving the demand for advanced diagnostic tools, including immunofluorescence assays. As healthcare providers seek to enhance diagnostic accuracy, the immunofluorescence assay market is experiencing notable growth. According to recent estimates, the market is projected to expand at a CAGR of approximately 8% over the next five years. This growth is attributed to the assay's ability to provide rapid and reliable results, which is crucial for timely patient management. Furthermore, the rising awareness among healthcare professionals regarding the benefits of immunofluorescence techniques is likely to further propel market expansion. As a result, the immunofluorescence assay market is positioned to play a pivotal role in the evolving landscape of diagnostic methodologies in the UK.

Growing Investment in Biotechnology

The UK has seen a marked increase in investment in biotechnology, which is a key driver for the immunofluorescence assay market. With government initiatives and private sector funding supporting biotechnological advancements, research institutions are better equipped to develop innovative diagnostic tools. This influx of capital is fostering an environment conducive to the growth of the immunofluorescence assay market, as researchers seek to leverage these assays for various applications, including drug discovery and disease diagnosis. The market is projected to reach a valuation of over $500 million by 2027, reflecting the growing recognition of immunofluorescence assays as essential tools in modern biotechnology. As such, the immunofluorescence assay market is poised to thrive amid this burgeoning investment landscape.

Advancements in Imaging Technologies

Recent advancements in imaging technologies are significantly impacting the immunofluorescence assay market. Innovations such as high-resolution microscopy and automated imaging systems are enhancing the capabilities of immunofluorescence assays, allowing for more precise and efficient analysis of samples. These technological improvements are likely to increase the adoption of immunofluorescence assays in both clinical and research settings across the UK. As laboratories seek to improve throughput and accuracy, the integration of advanced imaging solutions is becoming increasingly important. This trend suggests that the immunofluorescence assay market will continue to evolve, driven by the need for more sophisticated analytical tools that can meet the demands of modern biomedical research.

Increased Focus on Personalized Medicine

The shift towards personalized medicine in the UK healthcare system is significantly influencing the immunofluorescence assay market. As treatments become more tailored to individual patient profiles, the demand for assays that can accurately identify specific biomarkers is on the rise. Immunofluorescence assays are particularly well-suited for this purpose, as they allow for the visualization of specific proteins in cells and tissues. This capability is essential for developing targeted therapies, which are becoming increasingly prevalent in oncology and autoimmune diseases. The market is expected to witness a surge in investment as pharmaceutical companies and research institutions prioritize the development of personalized treatment options. Consequently, the immunofluorescence assay market is likely to benefit from this trend, as it aligns with the broader movement towards precision medicine in the UK.

Regulatory Support for Diagnostic Innovations

The regulatory landscape in the UK is becoming increasingly supportive of innovations in diagnostic technologies, including immunofluorescence assays. Regulatory bodies are streamlining approval processes for new diagnostic tools, which is likely to encourage the development and commercialization of novel assays. This supportive environment is crucial for fostering innovation within the immunofluorescence assay market, as it allows companies to bring their products to market more efficiently. Furthermore, as regulatory frameworks evolve to accommodate advancements in technology, the market is expected to benefit from increased confidence among healthcare providers and patients alike. This trend indicates a promising future for the immunofluorescence assay market, as it aligns with the broader goal of improving diagnostic capabilities in the UK.