Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases in France is a pivotal driver for the immunofluorescence assay market. Conditions such as cancer, autoimmune disorders, and infectious diseases necessitate advanced diagnostic tools. The demand for precise and rapid diagnostic methods is surging, as healthcare providers seek to improve patient outcomes. According to recent statistics, chronic diseases account for approximately 60% of all deaths in France, highlighting the urgent need for effective diagnostic solutions. This trend is likely to propel the adoption of immunofluorescence assays, which offer high sensitivity and specificity in detecting disease markers. As healthcare systems evolve to address these challenges, The immunofluorescence assay market is expected to expand significantly. This growth is driven by the need for innovative diagnostic technologies that can keep pace with the growing burden of chronic illnesses.

Advancements in Research and Development

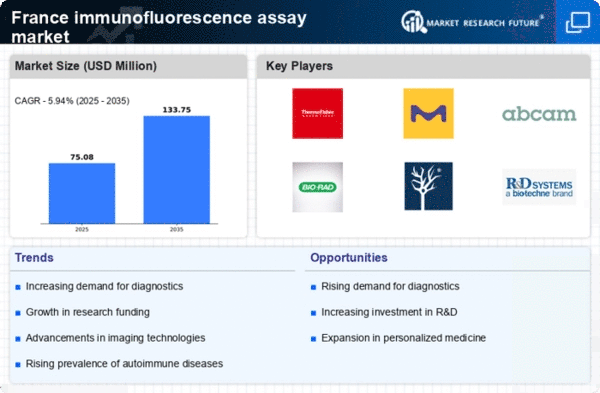

Ongoing advancements in research and development within the life sciences sector are significantly influencing the immunofluorescence assay market. French research institutions and biotechnology companies are increasingly investing in innovative technologies to enhance assay performance and expand their applications. The market is witnessing a shift towards multiplex assays, which allow for the simultaneous detection of multiple targets, thereby improving efficiency and reducing costs. Furthermore, the French government has allocated substantial funding to support biotechnology research, which is anticipated to foster innovation in immunofluorescence techniques. This focus on R&D is likely to lead to the introduction of novel assays and reagents, thereby driving market growth and enhancing the capabilities of immunofluorescence assays in both clinical and research settings.

Increased Focus on Personalized Medicine

The growing emphasis on personalized medicine in France is emerging as a crucial driver for the immunofluorescence assay market. As healthcare shifts towards tailored treatment approaches, the demand for precise diagnostic tools that can identify specific biomarkers is escalating. Immunofluorescence assays play a vital role in this paradigm by enabling the detection of unique protein expressions associated with individual patient profiles. This trend is supported by the increasing number of clinical trials aimed at developing targeted therapies, which often rely on immunofluorescence techniques for biomarker validation. The market is projected to benefit from this shift, as healthcare providers seek to implement personalized treatment strategies that improve patient outcomes and optimize therapeutic efficacy.

Growing Investment in Diagnostic Technologies

Investment in diagnostic technologies is witnessing a notable increase in France, which is positively impacting the immunofluorescence assay market. Both public and private sectors are channeling funds into the development of advanced diagnostic tools to enhance disease detection and monitoring. The French healthcare system is prioritizing the integration of innovative technologies to improve diagnostic accuracy and reduce healthcare costs. This trend is reflected in the rising number of partnerships between academic institutions and industry players, aimed at developing cutting-edge immunofluorescence assays. As a result, the market is likely to experience robust growth, driven by the influx of capital aimed at advancing diagnostic capabilities and improving patient care.

Regulatory Support for Diagnostic Innovations

Regulatory support for diagnostic innovations in France is a significant driver for the immunofluorescence assay market. The French regulatory framework is increasingly favorable towards the approval and commercialization of novel diagnostic technologies. This supportive environment encourages manufacturers to invest in the development of innovative immunofluorescence assays that meet stringent quality and safety standards. Additionally, the European Union's initiatives to streamline the regulatory process for in vitro diagnostics are likely to further facilitate market entry for new products. As regulatory barriers diminish, the immunofluorescence assay market is expected to expand, providing healthcare professionals with access to advanced diagnostic tools that enhance patient care and treatment outcomes.