Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases such as cancer, autoimmune disorders, and infectious diseases is a primary driver for the Immunofluorescence Assay Market. As these conditions become more prevalent, the demand for accurate diagnostic tools rises. Immunofluorescence assays are pivotal in detecting specific antigens in tissues, thereby aiding in the diagnosis and monitoring of these diseases. According to recent estimates, the prevalence of autoimmune diseases is projected to increase, which could lead to a heightened need for immunofluorescence assays. This trend suggests that the market will likely expand as healthcare providers seek reliable methods for disease detection and management.

Advancements in Research and Development

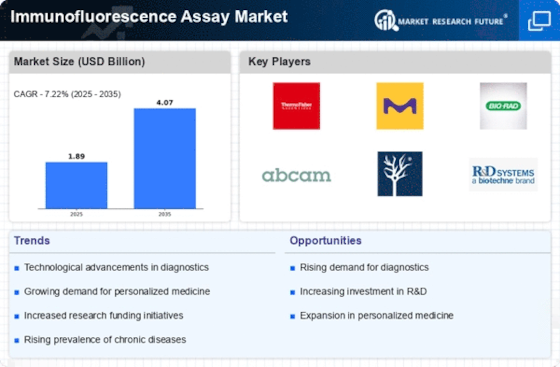

Ongoing advancements in research and development within the Immunofluorescence Assay Market are propelling market growth. Innovations in assay techniques, such as multiplexing capabilities, enhance the ability to detect multiple targets simultaneously, thereby improving efficiency and accuracy. Furthermore, the integration of artificial intelligence and machine learning in assay development is expected to streamline processes and reduce time-to-results. The market for immunofluorescence assays is anticipated to grow at a compound annual growth rate of approximately 7% over the next few years, driven by these technological advancements that facilitate more sophisticated research methodologies.

Growing Demand for Point-of-Care Testing

The shift towards point-of-care testing is significantly influencing the Immunofluorescence Assay Market. As healthcare systems aim to provide rapid and accurate diagnostic results, the demand for portable and user-friendly immunofluorescence assays is increasing. These assays allow for immediate results, which is crucial in clinical settings where timely decision-making is essential. The market is projected to see a surge in the development of point-of-care immunofluorescence assays, driven by the need for efficient diagnostic solutions. This trend may lead to a transformation in how diagnostics are conducted, further propelling market growth.

Increased Funding for Biomedical Research

The Immunofluorescence Assay Market is benefiting from increased funding for biomedical research initiatives. Governments and private organizations are allocating substantial resources to support research aimed at understanding complex diseases and developing novel therapeutic strategies. This influx of funding is likely to enhance the capabilities of laboratories, enabling them to adopt advanced immunofluorescence techniques. As a result, the demand for immunofluorescence assays is expected to rise, as researchers seek reliable and efficient tools for their studies. The trend indicates a robust growth trajectory for the market, as more research projects are initiated globally.

Expansion of Applications in Clinical Diagnostics

The expansion of applications for immunofluorescence assays in clinical diagnostics is a notable driver for the Immunofluorescence Assay Market. These assays are increasingly utilized in various fields, including oncology, infectious diseases, and immunology, for their ability to provide precise and reliable results. The versatility of immunofluorescence techniques allows for their application in both research and clinical settings, thereby broadening their market appeal. As healthcare providers continue to recognize the value of these assays in improving patient outcomes, the market is expected to experience sustained growth, reflecting the growing reliance on advanced diagnostic tools.