Increasing Urbanization

The rapid urbanization in China is a pivotal driver for the hair care market. As more individuals migrate to urban areas, there is a growing demand for personal grooming products, including hair care items. Urban consumers tend to have higher disposable incomes, which allows them to spend more on premium hair care products. In 2025, the urban population in China is projected to reach approximately 65% of the total population, indicating a substantial market for hair care brands. This demographic shift is likely to influence purchasing behaviors, with consumers seeking innovative and high-quality products. The hair care market is expected to benefit from this trend, as urban consumers increasingly prioritize personal appearance and grooming, leading to a surge in demand for diverse hair care solutions.

Influence of Social Media

Social media platforms play a crucial role in shaping consumer preferences within the hair care market. In China, platforms like WeChat and Douyin have become essential for brands to engage with consumers. Influencers and beauty bloggers often showcase hair care products, driving trends and consumer interest. As of 2025, it is estimated that over 70% of Chinese consumers rely on social media for beauty product recommendations. This trend suggests that brands must invest in digital marketing strategies to capture the attention of potential buyers. The hair care market is likely to see increased sales as brands leverage social media to promote their products, create brand loyalty, and connect with younger consumers who are more inclined to experiment with new hair care solutions.

Expansion of Retail Channels

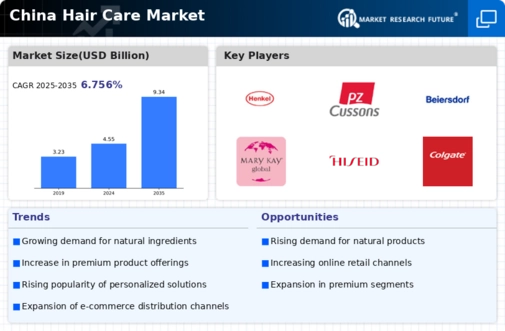

The expansion of retail channels in China is significantly impacting the hair care market. Traditional brick-and-mortar stores are increasingly complemented by online platforms, providing consumers with a wider array of purchasing options. In 2025, it is projected that online sales will account for over 30% of total hair care product sales in China. This shift towards e-commerce allows brands to reach a broader audience and cater to diverse consumer preferences. The hair care market is likely to benefit from this trend as retailers enhance their online presence and offer exclusive online promotions. Additionally, the integration of technology in retail, such as augmented reality for virtual try-ons, may further enhance the shopping experience, driving sales and consumer engagement.

Rising Awareness of Hair Health

There is a growing awareness among Chinese consumers regarding the importance of hair health, which serves as a significant driver for the hair care market. Consumers are increasingly seeking products that not only enhance appearance but also promote hair health. This trend is reflected in the rising sales of specialized hair care products, such as those targeting hair loss or damage repair. In 2025, the market for hair health products is expected to grow by approximately 15%, indicating a shift towards more health-conscious purchasing decisions. The hair care market is adapting to this demand by introducing formulations enriched with vitamins and natural ingredients that cater to health-oriented consumers. This focus on hair health is likely to reshape product offerings and marketing strategies within the industry.

Cultural Shifts Towards Self-Care

Cultural shifts in China towards self-care and wellness are emerging as a vital driver for the hair care market. As consumers increasingly prioritize personal well-being, there is a growing demand for products that promote self-care routines, including hair care. This trend is reflected in the rising popularity of at-home hair treatments and spa-like experiences. In 2025, the self-care segment within the hair care market is expected to grow by approximately 20%, indicating a shift in consumer behavior. The hair care market is responding to this trend by developing products that cater to the self-care movement, such as nourishing hair masks and treatments that enhance the overall hair care experience. This cultural evolution suggests a long-term opportunity for brands to align their offerings with the self-care ethos.