Emphasis on Data Security and Compliance

In the enterprise video market, data security and compliance have become critical considerations for organizations in China. With increasing regulatory scrutiny, companies are prioritizing secure video solutions that protect sensitive information. By 2025, it is expected that 80% of enterprises will implement stringent security measures for their video communications. This emphasis on security not only mitigates risks but also builds trust with clients and stakeholders. The enterprise video market is thus likely to evolve, with providers focusing on developing secure platforms that comply with local regulations, ensuring that businesses can operate confidently in a digital landscape.

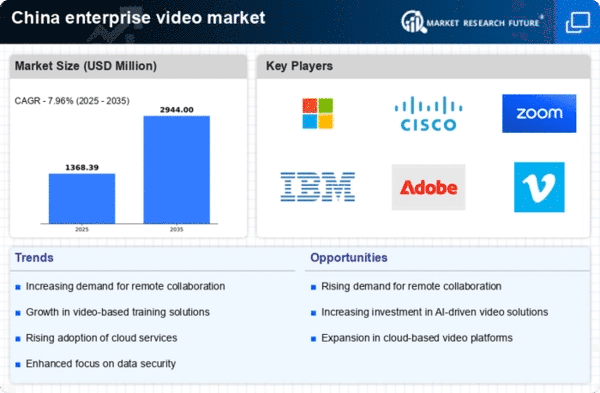

Rising Demand for Remote Collaboration Tools

The enterprise video market in China experiences a notable surge in demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for effective communication solutions becomes paramount. In 2025, it is estimated that approximately 70% of enterprises in China will utilize video conferencing tools to facilitate remote collaboration. This shift not only enhances productivity but also fosters a culture of inclusivity, allowing teams to connect seamlessly regardless of their physical location. The enterprise video market is thus positioned to benefit from this trend, as companies seek to invest in robust video solutions that support their evolving work environments.

Technological Advancements in Video Streaming

Technological advancements play a crucial role in shaping the enterprise video market in China. Innovations in video streaming technology, such as improved bandwidth and lower latency, enhance the user experience significantly. In 2025, the market is projected to grow by 15% annually, driven by these advancements. Enhanced video quality and reliability are essential for enterprises aiming to deliver professional-grade content. Furthermore, the integration of artificial intelligence in video solutions allows for features like real-time translation and automated transcription, which are increasingly sought after in the enterprise video market. These developments indicate a promising future for video solutions tailored to business needs.

Increased Investment in Digital Transformation

As businesses in China continue to prioritize digital transformation, the enterprise video market is poised for growth. Companies are allocating substantial budgets towards digital initiatives, with an estimated 30% of IT spending directed towards video solutions in 2025. This investment is driven by the need for enhanced communication, collaboration, and customer engagement. The enterprise video market stands to gain from this trend, as organizations seek to leverage video technology to streamline operations and improve overall efficiency. The alignment of video solutions with broader digital strategies indicates a robust future for the market.

Growing Focus on Employee Training and Development

The enterprise video market in China is witnessing a growing focus on employee training and development. Organizations recognize the value of video content in delivering training programs effectively. By 2025, it is anticipated that over 60% of companies will incorporate video-based training into their learning and development strategies. This trend not only enhances knowledge retention but also allows for scalable training solutions that can reach a wider audience. The enterprise video market is thus likely to see increased investment in platforms that facilitate the creation and distribution of training videos, reflecting a commitment to workforce development.