Aging Population

China's demographic shift towards an aging population is a significant driver for the china emergency medical device services market. By 2026, it is projected that over 300 million individuals will be aged 60 and above, creating an urgent need for effective emergency medical services. This demographic trend necessitates the development and deployment of specialized medical devices tailored to the needs of older patients, who often present with complex health issues. The government has recognized this challenge and is likely to implement policies aimed at enhancing emergency care capabilities. Consequently, the demand for emergency medical devices is expected to surge, as healthcare providers seek to equip themselves with the necessary tools to address the unique requirements of this growing population segment.

Rising Healthcare Expenditure

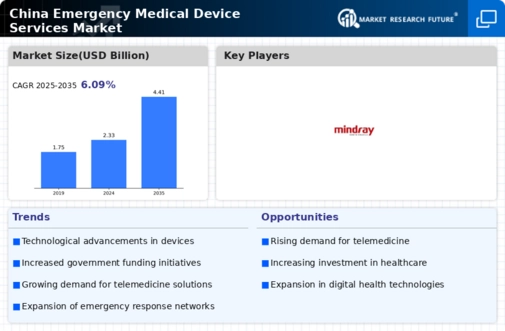

The increasing healthcare expenditure in China is a pivotal driver for the china emergency medical device services market. As the government allocates more funds to healthcare, the demand for advanced medical devices rises correspondingly. In 2025, China's healthcare spending reached approximately 7.2 trillion yuan, reflecting a growth rate of 10% from the previous year. This trend indicates a robust investment in emergency medical services, which necessitates the procurement of sophisticated medical devices. Furthermore, the expansion of healthcare infrastructure, particularly in rural areas, is likely to enhance access to emergency medical services, thereby propelling the market forward. The focus on improving emergency response capabilities aligns with national health objectives, suggesting a sustained growth trajectory for the industry.

Regulatory Support and Standards

Regulatory support and the establishment of stringent standards are vital drivers for the china emergency medical device services market. The Chinese government has implemented comprehensive regulations to ensure the safety and efficacy of medical devices. In 2025, the National Medical Products Administration introduced new guidelines aimed at expediting the approval process for innovative emergency medical devices. This regulatory framework not only fosters innovation but also instills confidence among manufacturers and healthcare providers. As compliance with these standards becomes mandatory, the market is likely to witness an influx of advanced medical devices designed for emergency services. The emphasis on quality and safety is expected to enhance the overall credibility of the industry, thereby attracting further investment.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare in China is emerging as a significant driver for the china emergency medical device services market. The government is actively promoting health awareness campaigns aimed at educating the public about the importance of early detection and timely intervention. This shift towards preventive measures is likely to increase the demand for emergency medical devices that facilitate rapid diagnosis and treatment. By 2026, it is anticipated that the market for diagnostic and monitoring devices will expand, reflecting a broader trend towards proactive healthcare management. The integration of emergency medical services with preventive healthcare initiatives suggests a holistic approach to health, potentially leading to a more resilient healthcare system and a thriving market for emergency medical devices.

Urbanization and Infrastructure Development

The rapid urbanization in China is a crucial driver for the china emergency medical device services market. As urban areas expand, the demand for efficient emergency medical services becomes increasingly critical. The government has invested heavily in healthcare infrastructure, with plans to establish more hospitals and emergency care facilities in urban centers. By 2025, it was estimated that urban healthcare facilities would increase by 15%, necessitating the acquisition of advanced medical devices to support these services. This infrastructure development is likely to enhance the overall efficiency of emergency medical responses, thereby driving the market for emergency medical devices. The integration of technology in urban healthcare systems further indicates a promising outlook for the industry.