The Cloud Application Security Market in China is characterized by a rapidly evolving competitive landscape, driven by increasing digital transformation initiatives and heightened awareness of cybersecurity threats. Major players such as Alibaba Cloud (CN), Tencent Cloud (CN), and Huawei Cloud (CN) are at the forefront, each adopting distinct strategies to enhance their market positioning. Alibaba Cloud (CN) focuses on innovation through continuous investment in AI-driven security solutions, while Tencent Cloud (CN) emphasizes partnerships with local enterprises to bolster its service offerings. Huawei Cloud (CN) is strategically expanding its global footprint, leveraging its extensive R&D capabilities to develop cutting-edge security technologies. Collectively, these strategies contribute to a dynamic competitive environment, where innovation and collaboration are paramount.

The market structure appears moderately fragmented, with several key players vying for dominance. Business tactics such as localizing services and optimizing supply chains are prevalent among these companies, allowing them to cater to the unique needs of the Chinese market. The collective influence of these major players shapes the competitive dynamics, as they strive to differentiate themselves through enhanced service delivery and customer engagement.

In December 2025, Alibaba Cloud (CN) announced a strategic partnership with a leading fintech company to develop integrated security solutions tailored for the financial sector. This collaboration is likely to enhance Alibaba Cloud's offerings, positioning it as a trusted provider of security solutions in a highly regulated industry. The partnership underscores the importance of aligning security capabilities with industry-specific needs, thereby strengthening customer trust and loyalty.

In November 2025, Tencent Cloud (CN) launched a new suite of security services aimed at small and medium-sized enterprises (SMEs). This initiative reflects Tencent's commitment to democratizing access to advanced security technologies, enabling SMEs to protect their digital assets effectively. By targeting this underserved segment, Tencent Cloud may capture a significant share of the market, fostering long-term growth and customer retention.

In October 2025, Huawei Cloud (CN) unveiled its latest AI-powered security platform, designed to proactively identify and mitigate threats in real-time. This development not only showcases Huawei's technological prowess but also highlights the increasing importance of AI in enhancing cybersecurity measures. The introduction of such advanced solutions is likely to set new benchmarks in the industry, compelling competitors to innovate further.

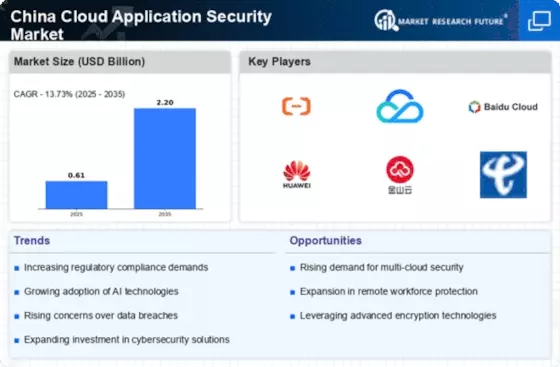

As of January 2026, current trends in the Cloud Application Security Market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming increasingly vital, as companies recognize the need to collaborate to enhance their service offerings and address complex security challenges. Looking ahead, competitive differentiation is expected to evolve, shifting from price-based competition to a focus on innovation, technological advancement, and supply chain reliability. This transition may redefine the competitive landscape, compelling companies to invest in cutting-edge solutions that meet the evolving demands of their customers.