Rising Cyber Threats

The escalating frequency and sophistication of cyber threats are driving the demand for cloud application security solutions in the France Cloud Application Security Market. Organizations are increasingly targeted by cybercriminals, leading to significant financial losses and reputational damage. In 2025, it was reported that cyberattacks on French businesses increased by 40% compared to the previous year, underscoring the urgent need for enhanced security measures. This alarming trend is prompting companies to invest in comprehensive security solutions that can effectively safeguard their cloud applications. As the threat landscape continues to evolve, the market is likely to expand as organizations prioritize security investments to protect their digital assets.

Growing Adoption of Cloud Services

The rapid adoption of cloud services across various industries is a key driver of the France Cloud Application Security Market. As organizations migrate their operations to the cloud, the need for robust security measures becomes paramount. In 2025, it was estimated that over 70% of French enterprises had adopted cloud solutions, highlighting a significant shift towards cloud-based operations. This transition necessitates the implementation of effective security protocols to protect sensitive data and ensure compliance with regulations. Consequently, the market for cloud application security solutions is expected to grow as businesses seek to secure their cloud environments against potential threats. The increasing reliance on cloud services is likely to shape the future landscape of the security market in France.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) technologies into cloud application security solutions is transforming the France Cloud Application Security Market. AI-driven tools enhance threat detection and response capabilities, allowing organizations to proactively identify vulnerabilities and mitigate risks. In 2025, the adoption of AI in security solutions accounted for nearly 30% of the market share, indicating a strong trend towards automation and intelligent security measures. This shift not only improves efficiency but also reduces the burden on security teams, enabling them to focus on more strategic initiatives. As AI technologies continue to evolve, their impact on the cloud application security landscape in France is expected to grow, potentially reshaping the competitive dynamics of the market.

Regulatory Compliance and Data Protection

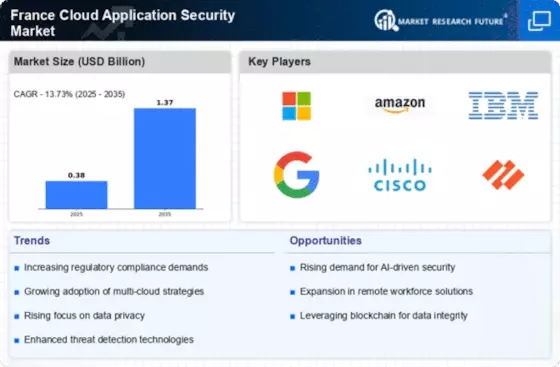

The France Cloud Application Security Market is significantly influenced by stringent regulatory frameworks such as the General Data Protection Regulation (GDPR). These regulations mandate that organizations implement robust security measures to protect sensitive data. As a result, businesses are increasingly investing in cloud application security solutions to ensure compliance and avoid hefty fines. The market is projected to grow as companies seek to enhance their security posture in response to regulatory pressures. In 2025, the market size for cloud application security in France reached approximately 1.2 billion euros, reflecting a growing awareness of data protection requirements. This trend is likely to continue as new regulations emerge, further driving the demand for advanced security solutions.

Collaboration Between Public and Private Sectors

The France Cloud Application Security Market is witnessing increased collaboration between public and private sectors to enhance cybersecurity resilience. Government initiatives aimed at fostering partnerships with private enterprises are becoming more prevalent, as they recognize the importance of a unified approach to security. For instance, the French government has launched several initiatives to promote information sharing and best practices among organizations. This collaborative environment is likely to lead to the development of innovative security solutions tailored to the unique challenges faced by various sectors. As a result, the market is expected to benefit from enhanced security frameworks and shared resources, ultimately improving the overall security posture of cloud applications in France.