Rising Cybersecurity Threats

The escalating frequency and sophistication of cybersecurity threats are significant drivers of the Germany Cloud Application Security Market. As cybercriminals employ increasingly advanced tactics, organizations are compelled to invest in robust cloud security solutions to protect their assets. In 2025, the number of reported cyber incidents in Germany reached an all-time high, prompting businesses to reassess their security strategies. The market for cloud security solutions is expected to grow from 1.8 billion euros in 2025 to 2.6 billion euros by 2027, reflecting the urgent need for enhanced security measures. Additionally, the German government has launched initiatives to bolster national cybersecurity, further emphasizing the importance of cloud application security. This environment of heightened threat awareness is likely to drive organizations to prioritize investments in cloud security technologies.

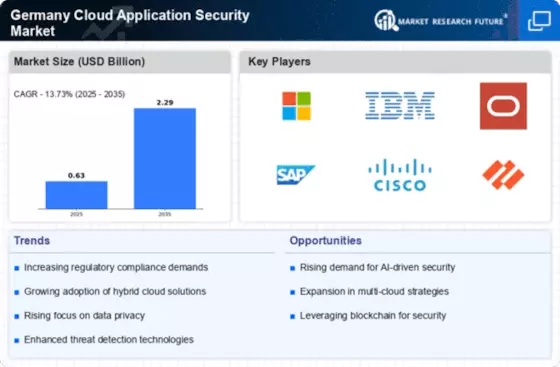

Increased Regulatory Compliance

The Germany Cloud Application Security Market is experiencing a surge in demand due to heightened regulatory compliance requirements. The European Union's General Data Protection Regulation (GDPR) mandates stringent data protection measures, compelling organizations to adopt robust cloud security solutions. As companies strive to align with these regulations, the market is projected to grow significantly. In 2025, the market was valued at approximately 1.5 billion euros, and it is expected to reach 2.3 billion euros by 2027. This growth is indicative of the increasing emphasis on compliance, as businesses recognize the potential legal ramifications of non-compliance. Furthermore, the German Federal Office for Information Security (BSI) has introduced guidelines that further necessitate the implementation of cloud security measures, thereby driving the market forward.

Focus on Data Privacy and Protection

Data privacy and protection remain at the forefront of concerns within the Germany Cloud Application Security Market. With increasing incidents of data breaches and cyberattacks, organizations are prioritizing the safeguarding of sensitive information. The German government has implemented various initiatives aimed at enhancing data protection, including the Digital Strategy 2025, which emphasizes the importance of secure cloud environments. As a result, the market for cloud application security solutions is projected to grow from 1.2 billion euros in 2025 to 1.9 billion euros by 2027. This growth is indicative of the rising awareness among businesses regarding the need for comprehensive data protection strategies. Furthermore, the emphasis on data sovereignty in Germany necessitates that organizations adopt cloud security measures that comply with local regulations, thereby driving market expansion.

Growing Demand for Remote Work Solutions

The shift towards remote work has catalyzed a growing demand for secure cloud application solutions within the Germany Cloud Application Security Market. As organizations adapt to flexible work arrangements, the need for secure access to cloud applications has become paramount. In 2025, approximately 60% of German companies reported an increase in remote work, leading to a corresponding rise in the adoption of cloud security measures. The market is projected to expand from 1.4 billion euros in 2025 to 2.1 billion euros by 2027, driven by the necessity for secure collaboration tools and data access. Furthermore, the German government has recognized the importance of secure remote work environments, promoting initiatives that encourage the adoption of cloud security solutions. This trend underscores the critical role of cloud application security in facilitating a secure and efficient remote work landscape.

Adoption of Advanced Security Technologies

The integration of advanced security technologies is a pivotal driver in the Germany Cloud Application Security Market. Organizations are increasingly adopting artificial intelligence (AI) and machine learning (ML) to enhance their security postures. These technologies enable real-time threat detection and response, which is crucial in an era where cyber threats are becoming more sophisticated. In 2025, the market for AI-driven security solutions in Germany was estimated at 400 million euros, with projections indicating a growth to 600 million euros by 2027. This trend reflects a broader shift towards proactive security measures, as businesses seek to mitigate risks before they escalate. Additionally, the rise of zero-trust security models is prompting organizations to reassess their cloud security strategies, further propelling the demand for innovative solutions.