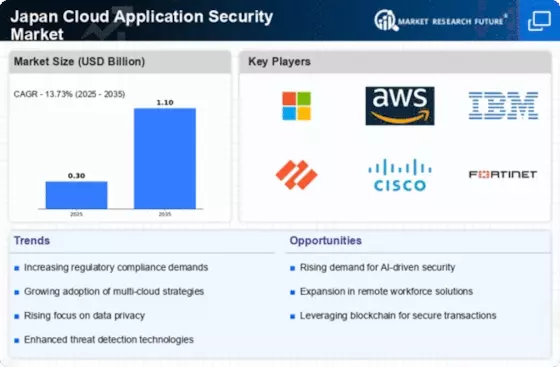

The Cloud Application Security Market in Japan is characterized by a dynamic competitive landscape, driven by the increasing demand for robust security solutions amid the rapid digital transformation across various sectors. Key players such as Microsoft (JP), Amazon Web Services (JP), and Trend Micro (JP) are at the forefront, each adopting distinct strategies to enhance their market positioning. Microsoft (JP) focuses on innovation through its Azure platform, integrating advanced security features that cater to enterprise needs. In contrast, Amazon Web Services (JP) emphasizes scalability and flexibility, offering a wide range of security tools that appeal to diverse customer segments. Trend Micro (JP), with its strong local presence, prioritizes partnerships with regional businesses to tailor solutions that address specific security challenges, thereby shaping a competitive environment that is both collaborative and competitive.

The business tactics employed by these companies reflect a nuanced understanding of the market's structure, which appears moderately fragmented yet increasingly competitive. Localizing manufacturing and optimizing supply chains are common strategies that enhance operational efficiency and responsiveness to market demands. The collective influence of these key players fosters an environment where innovation and customer-centric solutions are paramount, driving the overall growth of the market.

In December 2025, Microsoft (JP) announced the launch of its new security feature within the Azure platform, aimed at enhancing threat detection capabilities. This strategic move underscores Microsoft's commitment to maintaining its leadership position by leveraging cutting-edge technology to address evolving security threats. The introduction of this feature is likely to attract more enterprise clients seeking comprehensive security solutions, thereby reinforcing Microsoft's competitive edge.

In November 2025, Amazon Web Services (JP) expanded its partnership with a leading Japanese telecommunications company to enhance cloud security offerings. This collaboration is significant as it allows AWS to tap into the telecom provider's extensive customer base, facilitating the delivery of tailored security solutions. Such strategic alliances are indicative of a broader trend where companies seek to combine strengths to offer more robust services, ultimately benefiting end-users.

In October 2025, Trend Micro (JP) launched a new initiative focused on AI-driven security analytics, aimed at improving threat response times for its clients. This initiative reflects a growing trend towards integrating artificial intelligence into security solutions, which is becoming increasingly vital in the face of sophisticated cyber threats. By prioritizing AI, Trend Micro positions itself as a forward-thinking player in the market, likely enhancing its appeal to tech-savvy organizations.

As of January 2026, the competitive trends within the Cloud Application Security Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are shaping the landscape, enabling companies to pool resources and expertise to deliver innovative solutions. Looking ahead, competitive differentiation is expected to evolve, with a shift from price-based competition towards a focus on innovation, technology, and supply chain reliability. This transition suggests that companies that prioritize these aspects will likely emerge as leaders in the market.