Rising Demand for Transparency

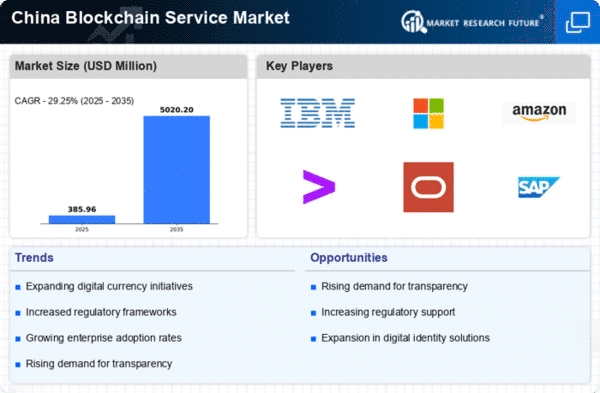

The blockchain service market in China experiences a notable surge in demand for transparency across various sectors. This demand is driven by the need for enhanced traceability in supply chains, particularly in industries such as food and pharmaceuticals. As consumers become increasingly aware of product origins, companies are compelled to adopt blockchain solutions to provide verifiable information. In 2025, it is estimated that the market for blockchain services related to transparency could reach approximately $5 billion, reflecting a growth rate of around 30% annually. This trend indicates that businesses are prioritizing transparency to build trust with consumers, thereby propelling the blockchain service market forward.

Increased Focus on Cybersecurity

As cyber threats continue to evolve, the blockchain service market in China is witnessing an increased focus on cybersecurity solutions. Blockchain's inherent characteristics, such as immutability and decentralization, provide a robust framework for enhancing data security. Organizations are increasingly adopting blockchain services to safeguard sensitive information and transactions. In 2025, the market for blockchain-based cybersecurity solutions is anticipated to reach $2 billion, reflecting a growing recognition of the technology's potential to mitigate risks. This heightened emphasis on cybersecurity is likely to drive further investment in blockchain services, reinforcing its position as a critical component of digital security strategies.

Growing Interest from Enterprises

The blockchain service market in China is experiencing a growing interest from enterprises seeking to leverage blockchain for operational efficiency and cost reduction. Companies across various sectors, including finance, healthcare, and logistics, are exploring blockchain solutions to streamline processes and enhance collaboration. In 2025, it is projected that enterprise adoption of blockchain services could account for over 40% of the total market share, driven by the potential for significant cost savings and improved operational transparency. This trend suggests that as enterprises recognize the value of blockchain, the market is likely to witness accelerated growth, fostering innovation and competitive advantage.

Government Initiatives and Support

The Chinese government plays a pivotal role in fostering the blockchain service market through various initiatives and support mechanisms. Policies aimed at promoting technological innovation and digital transformation have led to increased investment in blockchain technologies. In 2025, government funding for blockchain projects is projected to exceed $1 billion, highlighting the commitment to integrating blockchain into public services and infrastructure. This support not only encourages startups but also attracts established companies to explore blockchain applications. Consequently, the blockchain service market is likely to expand as a result of these favorable governmental policies, creating a conducive environment for innovation.

Integration with Internet of Things (IoT)

The convergence of blockchain technology with the Internet of Things (IoT) is emerging as a significant driver for the blockchain service market in China. As IoT devices proliferate, the need for secure and efficient data management becomes paramount. Blockchain offers a decentralized solution that enhances data integrity and security, making it an attractive option for industries such as manufacturing and logistics. By 2025, the integration of blockchain with IoT is expected to contribute to a market value of approximately $3 billion within the blockchain service market. This synergy not only streamlines operations but also fosters innovation in smart cities and automated systems.