Government Initiatives and Support

Government initiatives and support are pivotal in the development of the Biometric ATM Market in China. The Chinese government has been actively promoting the adoption of biometric technologies across various sectors, including banking. Policies aimed at enhancing cybersecurity and protecting consumer data are encouraging financial institutions to invest in biometric solutions. Additionally, the government's focus on digital transformation and smart city initiatives is likely to create a conducive environment for the growth of the biometric atm market. With funding and resources allocated to support technological innovation, banks are more inclined to implement biometric systems. This supportive regulatory framework is expected to facilitate a market expansion, with estimates suggesting a growth rate of around 25% over the next few years.

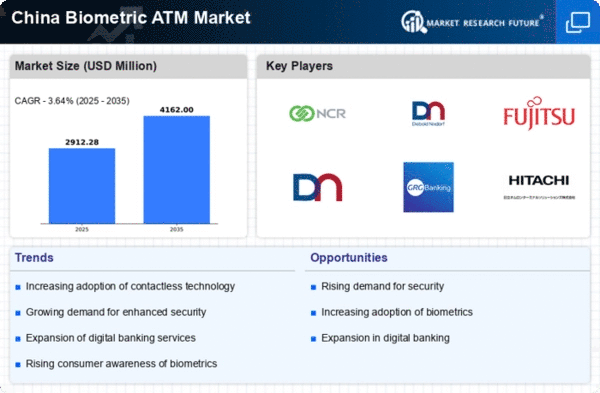

Rising Demand for Enhanced Security

The Biometric ATM Market in China is experiencing a notable surge in demand for enhanced security features. As financial institutions and consumers alike prioritize safety, the integration of biometric technologies such as fingerprint and facial recognition systems is becoming increasingly prevalent. This shift is driven by the need to combat fraud and identity theft, which have been rising concerns in the banking sector. According to recent data, the adoption of biometric systems in ATMs is projected to grow by approximately 30% annually over the next five years. This trend indicates a robust market potential for biometric solutions, as banks seek to bolster their security measures and improve customer trust in their services. Consequently, the biometric atm market is likely to expand significantly as institutions invest in advanced technologies to meet these security demands.

Technological Advancements in Biometric Systems

Technological advancements play a crucial role in shaping the Biometric ATM Market in China. Innovations in biometric recognition technologies, such as improved algorithms and faster processing capabilities, are enhancing the efficiency and accuracy of these systems. The introduction of multi-modal biometric systems, which combine various recognition methods, is also gaining traction. This evolution is expected to drive market growth, as financial institutions seek to offer seamless and secure transactions to their customers. Furthermore, the increasing affordability of biometric hardware and software solutions is likely to encourage more banks to adopt these technologies. As a result, the biometric atm market is poised for significant growth, with projections indicating a potential market size increase of over $1 billion by 2027.

Competitive Pressure Among Financial Institutions

Competitive pressure among financial institutions is a significant driver of the Biometric ATM Market in China. As banks strive to differentiate themselves in a crowded marketplace, the adoption of innovative technologies such as biometrics is becoming a strategic imperative. Institutions are increasingly recognizing that offering advanced security features can enhance customer loyalty and attract new clients. This competitive landscape is prompting banks to invest in biometric solutions to stay ahead of rivals. Furthermore, partnerships with technology providers are becoming more common, enabling banks to leverage cutting-edge biometric systems. As a result, the biometric atm market is expected to grow rapidly, with projections indicating a potential increase in market share of up to 20% within the next few years.

Consumer Preference for Convenient Banking Solutions

Consumer preferences are shifting towards more convenient banking solutions, significantly impacting the Biometric ATM Market in China. As customers increasingly seek faster and more efficient transaction methods, biometric ATMs offer a compelling alternative to traditional banking methods. The ability to authenticate identity quickly through biometric features reduces wait times and enhances user experience. Recent surveys indicate that over 60% of consumers express a preference for biometric authentication over PINs or cards, highlighting a growing acceptance of these technologies. This trend suggests that financial institutions must adapt to meet consumer expectations, driving the adoption of biometric systems in ATMs. Consequently, the biometric atm market is likely to witness substantial growth as banks strive to align their services with consumer demands for convenience and efficiency.