Government Initiatives and Funding

Government support plays a crucial role in the development of the 3D printed medical implants market. In China, various initiatives aimed at promoting advanced manufacturing technologies are being implemented, which include funding for research and development in 3D printing. The Chinese government has allocated substantial resources to enhance the capabilities of the healthcare sector, with a focus on innovative medical solutions. This support is likely to foster collaboration between academic institutions and industry players, leading to breakthroughs in implant technology. As a result, the 3d printed-medical-implants market is expected to benefit from increased investment and innovation, potentially reaching a market size of $2 billion by 2027. The proactive stance of the government in facilitating advancements in medical technology is a significant driver for the growth of this market.

Rising Demand for Personalized Healthcare

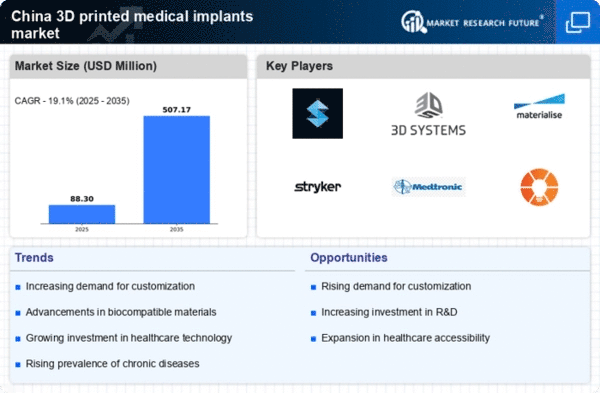

The increasing emphasis on personalized healthcare solutions is driving the 3D printed medical implants market. Patients are increasingly seeking implants that are tailored to their specific anatomical requirements, which traditional manufacturing methods struggle to provide. In China, the market for personalized medical implants is anticipated to grow at a CAGR of around 25% over the next few years. This shift towards customization is not only enhancing patient satisfaction but also improving recovery times and overall health outcomes. As healthcare providers recognize the benefits of personalized implants, investment in 3D printing technologies is likely to rise, further propelling the growth of the 3d printed-medical-implants market. The ability to produce unique implants on-demand aligns with the broader trend of patient-centered care, making this driver particularly relevant in the current healthcare landscape.

Technological Advancements in 3D Printing

The rapid evolution of 3D printing technologies is a pivotal driver for the 3D printed medical implants market. Innovations such as bioprinting and multi-material printing are enhancing the capabilities of medical implants, allowing for more complex and functional designs. In China, the adoption of these advanced technologies is projected to increase, with the market expected to reach approximately $1.5 billion by 2026. This growth is fueled by the demand for customized implants that cater to individual patient needs, thereby improving surgical outcomes. Furthermore, the integration of artificial intelligence in the design process is likely to streamline production and reduce costs, making 3D printed implants more accessible to healthcare providers. As a result, the technological advancements in 3D printing are expected to significantly impact the growth trajectory of the 3d printed-medical-implants market.

Aging Population and Increased Surgical Procedures

The demographic shift towards an aging population in China is a significant driver for the 3D printed medical implants market. As the population ages, the prevalence of chronic diseases and the need for surgical interventions are on the rise. This trend is expected to lead to an increased demand for medical implants, particularly orthopedic and dental implants. By 2030, it is estimated that over 300 million individuals in China will be aged 60 and above, creating a substantial market for 3D printed medical solutions. The ability to produce customized implants that cater to the unique anatomical needs of older patients is likely to enhance surgical outcomes and patient satisfaction. Consequently, the aging population is poised to be a key factor driving the growth of the 3d printed-medical-implants market.

Collaboration Between Healthcare and Technology Sectors

The collaboration between healthcare providers and technology companies is emerging as a vital driver for the 3D printed medical implants market. In China, partnerships between hospitals and 3D printing firms are becoming increasingly common, facilitating the development of innovative medical solutions. These collaborations enable healthcare professionals to leverage cutting-edge technology to create customized implants that meet specific patient needs. As a result, the efficiency of the production process is likely to improve, reducing lead times and costs associated with traditional manufacturing methods. This synergy between sectors is expected to enhance the overall quality of care and expand the market for 3D printed medical implants. The ongoing collaboration efforts are indicative of a broader trend towards integrated healthcare solutions, which could significantly influence the future landscape of the 3d printed-medical-implants market.