Technological Advancements

The Chemical Licensing Market is experiencing a surge in technological advancements that enhance the efficiency and effectiveness of chemical processes. Innovations in automation, artificial intelligence, and data analytics are streamlining operations, thereby reducing costs and improving product quality. For instance, the integration of AI in chemical manufacturing allows for real-time monitoring and predictive maintenance, which can lead to a reduction in downtime. As companies adopt these technologies, they are likely to gain a competitive edge, driving growth in the Chemical Licensing Market. Furthermore, the increasing demand for specialty chemicals, which often require advanced production techniques, is expected to further propel the market. This trend indicates a shift towards more sophisticated chemical production methods, which could reshape the landscape of the Chemical Licensing Market.

Sustainability and Green Chemistry

The Chemical Licensing Market is increasingly influenced by the shift towards sustainability and green chemistry practices. As environmental awareness grows, companies are under pressure to adopt eco-friendly processes and products. This has led to a rise in the development of sustainable chemical solutions, which often require specialized knowledge and technology. Licensing agreements are becoming a strategic tool for companies to access innovative green technologies that align with sustainability goals. For instance, firms may license biobased chemical processes that reduce reliance on fossil fuels. The emphasis on sustainability not only meets regulatory demands but also appeals to environmentally conscious consumers. This trend indicates a transformative phase for the Chemical Licensing Market, as businesses strive to balance profitability with environmental responsibility.

Emerging Markets and Economic Growth

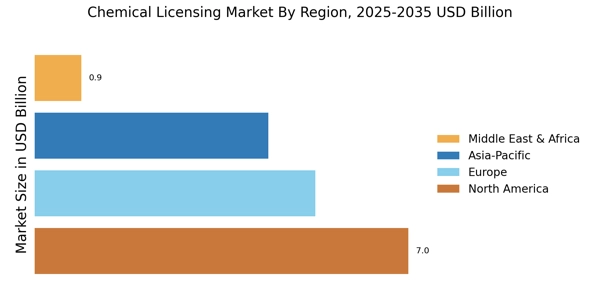

The Chemical Licensing Market is poised for expansion, particularly in emerging markets where economic growth is accelerating. Countries in Asia and Latin America are experiencing industrialization and urbanization, leading to increased demand for chemicals in various applications. This economic growth is expected to create a favorable environment for chemical manufacturers, prompting them to seek licensing agreements to expand their market presence. For example, the rise of the middle class in these regions is driving consumption patterns that favor specialty and performance chemicals. As a result, companies are likely to invest in local partnerships and licensing arrangements to tap into these burgeoning markets. This trend suggests a promising outlook for the Chemical Licensing Market, as firms adapt to the changing economic landscape and consumer preferences.

Rising Demand for Specialty Chemicals

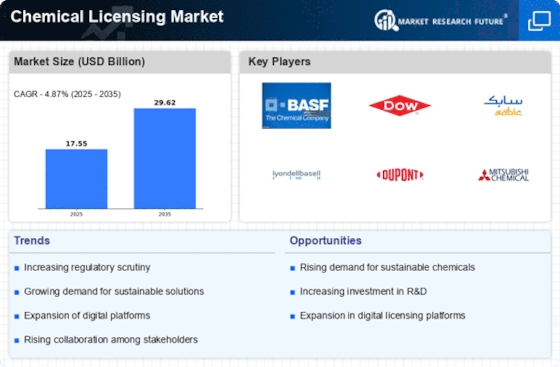

The Chemical Licensing Market is witnessing a notable increase in the demand for specialty chemicals across various sectors, including pharmaceuticals, agriculture, and consumer goods. Specialty chemicals are often tailored for specific applications, which makes them essential in enhancing product performance. According to recent data, the specialty chemicals segment is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This growth is driven by the need for innovative solutions that meet the evolving requirements of end-users. As companies seek to capitalize on this trend, they are likely to engage in licensing agreements to access proprietary technologies and formulations. This dynamic is expected to create new opportunities within the Chemical Licensing Market, as firms strive to differentiate their offerings and meet the increasing consumer demand for specialized products.

Regulatory Compliance and Safety Standards

The Chemical Licensing Market is significantly influenced by the stringent regulatory compliance and safety standards imposed by various authorities. As environmental concerns and safety issues gain prominence, companies are compelled to adhere to rigorous regulations governing chemical production and usage. This has led to an increased focus on obtaining licenses that ensure compliance with local and international standards. For instance, the implementation of REACH regulations in Europe has necessitated that companies invest in research and development to meet safety requirements. Consequently, this trend is likely to drive the demand for chemical licensing services, as firms seek to navigate the complex regulatory landscape. The emphasis on compliance not only enhances safety but also fosters consumer trust, which is crucial for the sustained growth of the Chemical Licensing Market.